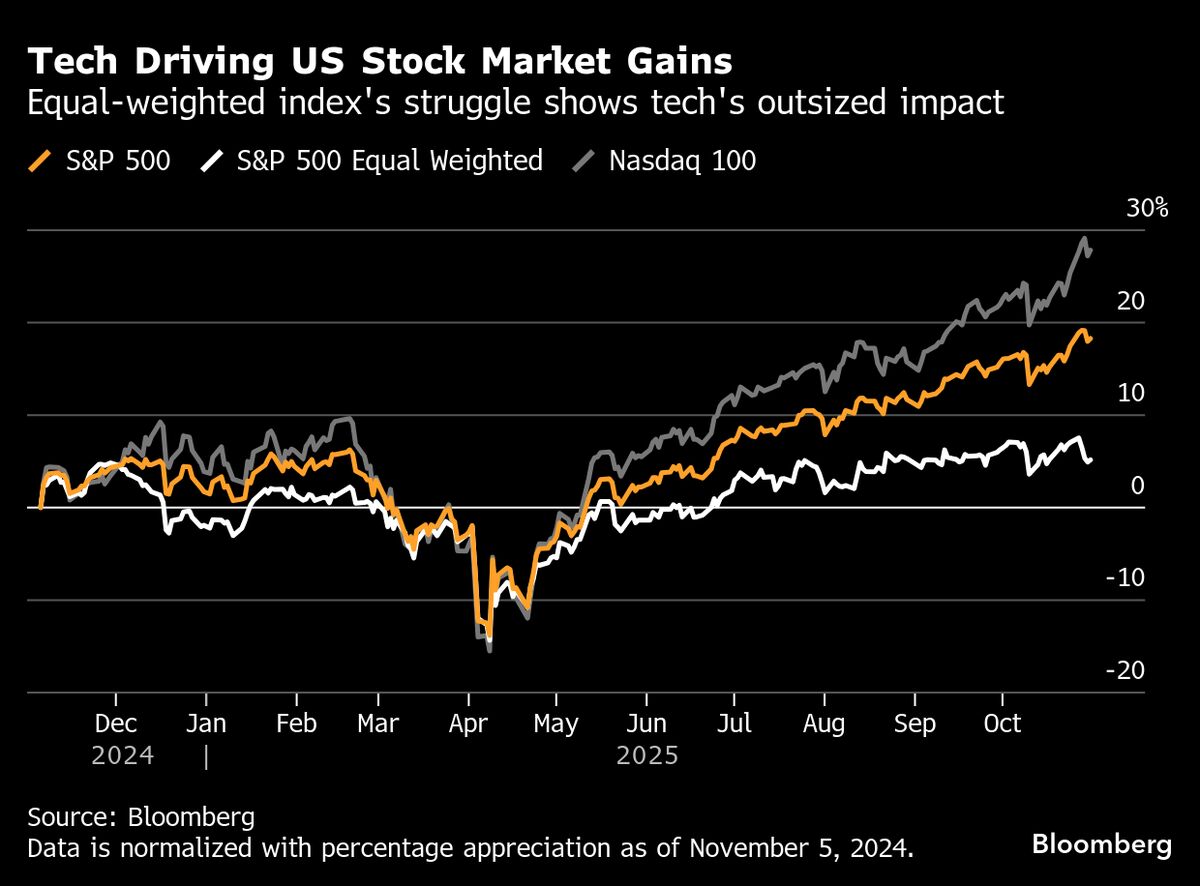

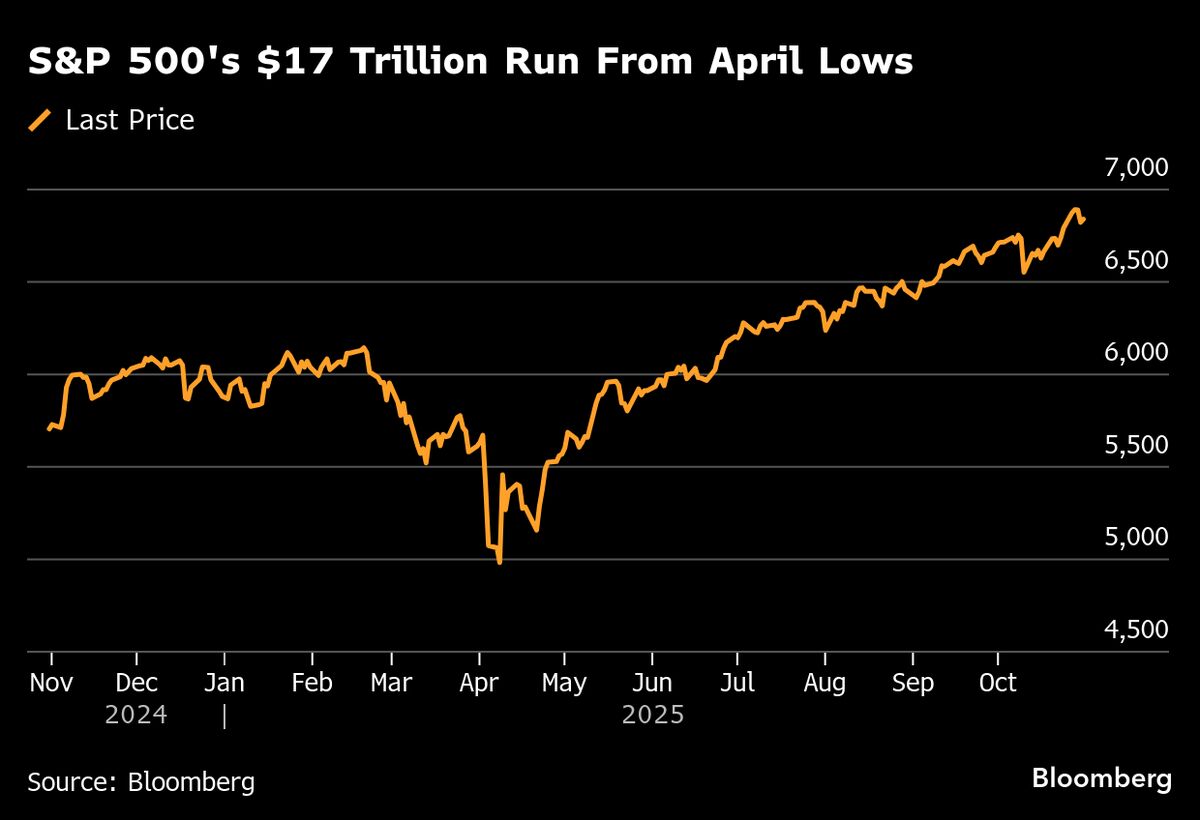

It’s getting harder to separate the stock market from the economy. That means the Fed and Congress have more incentive to help Wall Street

PositiveFinancial Markets

Recent findings from Oxford Economics reveal that a $1 increase in stock wealth now leads to a $0.05 increase in consumer spending, a significant rise from just $0.02 in 2010. This shift highlights the growing connection between the stock market and the economy, suggesting that both the Federal Reserve and Congress may feel more compelled to support Wall Street. Understanding this relationship is crucial as it could influence economic policies and consumer behavior moving forward.

— Curated by the World Pulse Now AI Editorial System