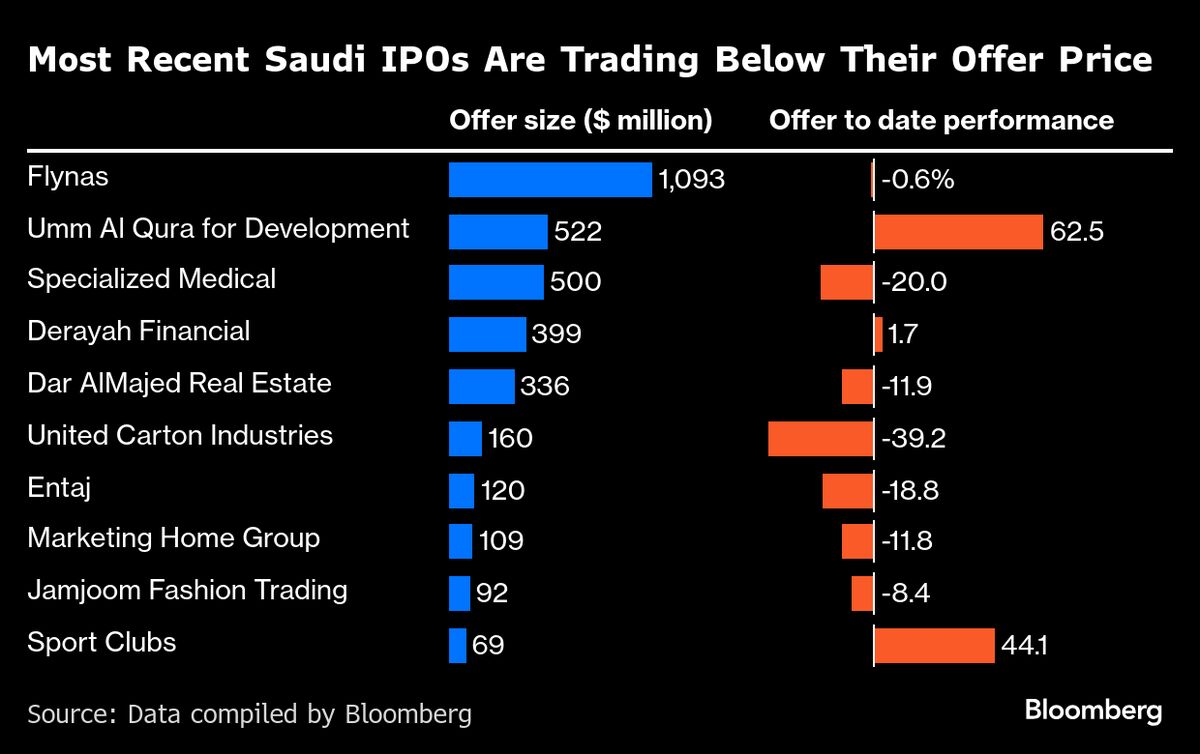

Money talks: the deep ties between Twitter and Saudi Arabia

NegativeFinancial Markets

The relationship between Saudi Arabia and Twitter has raised significant concerns, as the kingdom's investment has not only bolstered its influence in Silicon Valley but has also been leveraged to suppress dissent at home. Critics argue that this dynamic undermines the platform's integrity and freedom of expression, highlighting the troubling intersection of technology and authoritarianism. As Twitter navigates its challenges, the implications of such foreign investments on social media governance and user rights are becoming increasingly critical.

— Curated by the World Pulse Now AI Editorial System