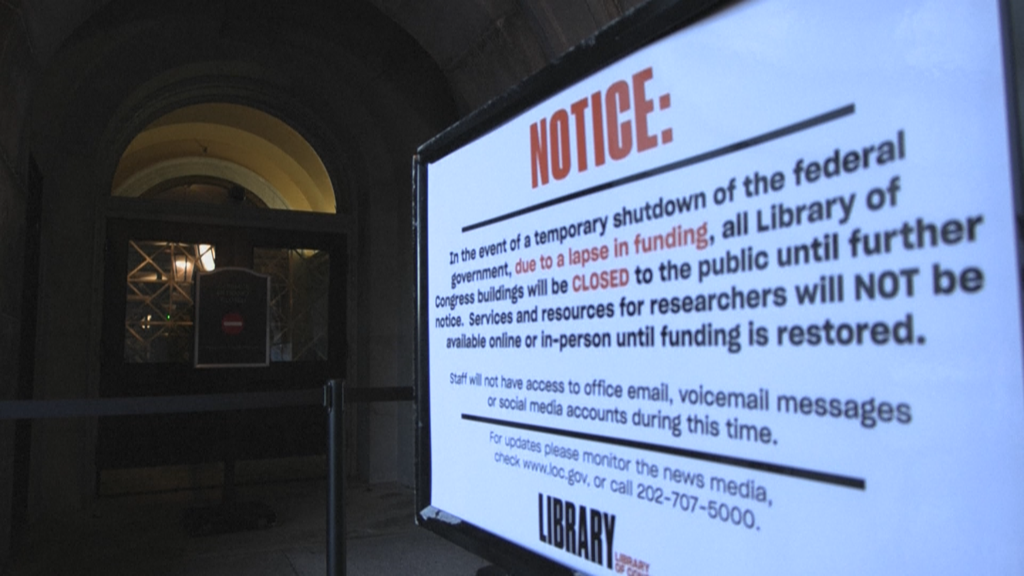

US government remains shut as senators fail to agree funding plan

NegativeFinancial Markets

The US government remains in a state of shutdown as senators were unable to reach an agreement on a funding plan. This ongoing impasse highlights the deepening divide between Republicans and Democrats, who continue to trade blame for the situation. The failure to secure a deal not only affects government operations but also impacts millions of Americans who rely on federal services. It's a critical moment that underscores the challenges of bipartisan cooperation in addressing urgent national issues.

— Curated by the World Pulse Now AI Editorial System