China Chip Stocks Test Trader Patience With Soaring Valuations

NeutralFinancial Markets

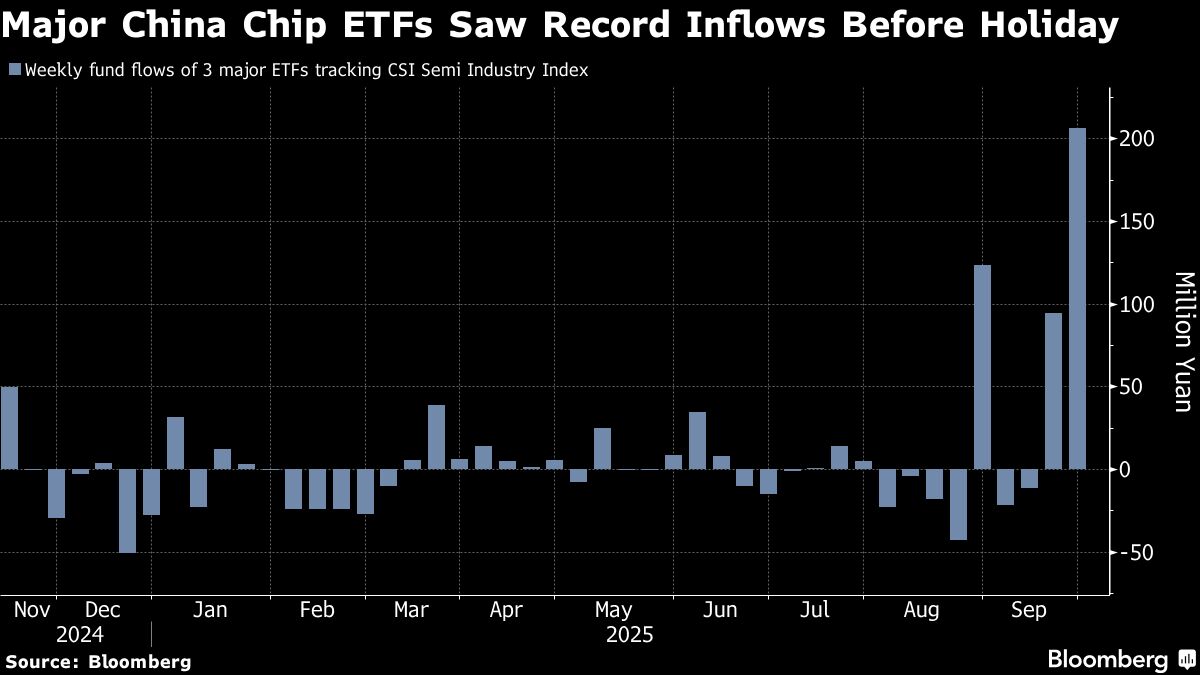

China's chip stocks have experienced a remarkable surge recently, driven by the country's push for self-sufficiency in technology. However, as valuations reach new heights, some investors are starting to express concerns about whether these stocks can maintain their momentum. This situation is significant as it reflects the broader trends in the tech industry and the ongoing competition in global markets.

— Curated by the World Pulse Now AI Editorial System