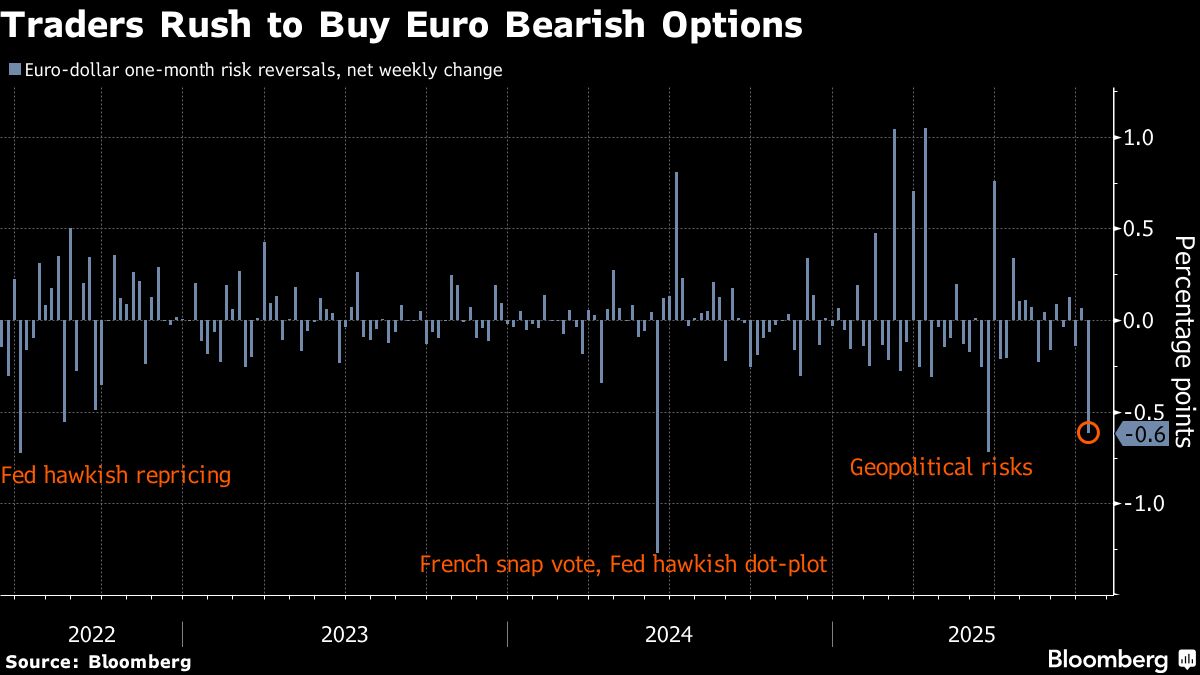

Take Five: The perils of politics

NegativeFinancial Markets

The article delves into the challenges and dangers associated with the current political landscape, highlighting how divisive politics can undermine public trust and lead to instability. It emphasizes the importance of understanding these dynamics as they affect not only governance but also the everyday lives of citizens. Recognizing these perils is crucial for fostering a more informed and engaged electorate.

— Curated by the World Pulse Now AI Editorial System