ECB: What to Expect From Today’s Decision in Florence

NeutralFinancial Markets

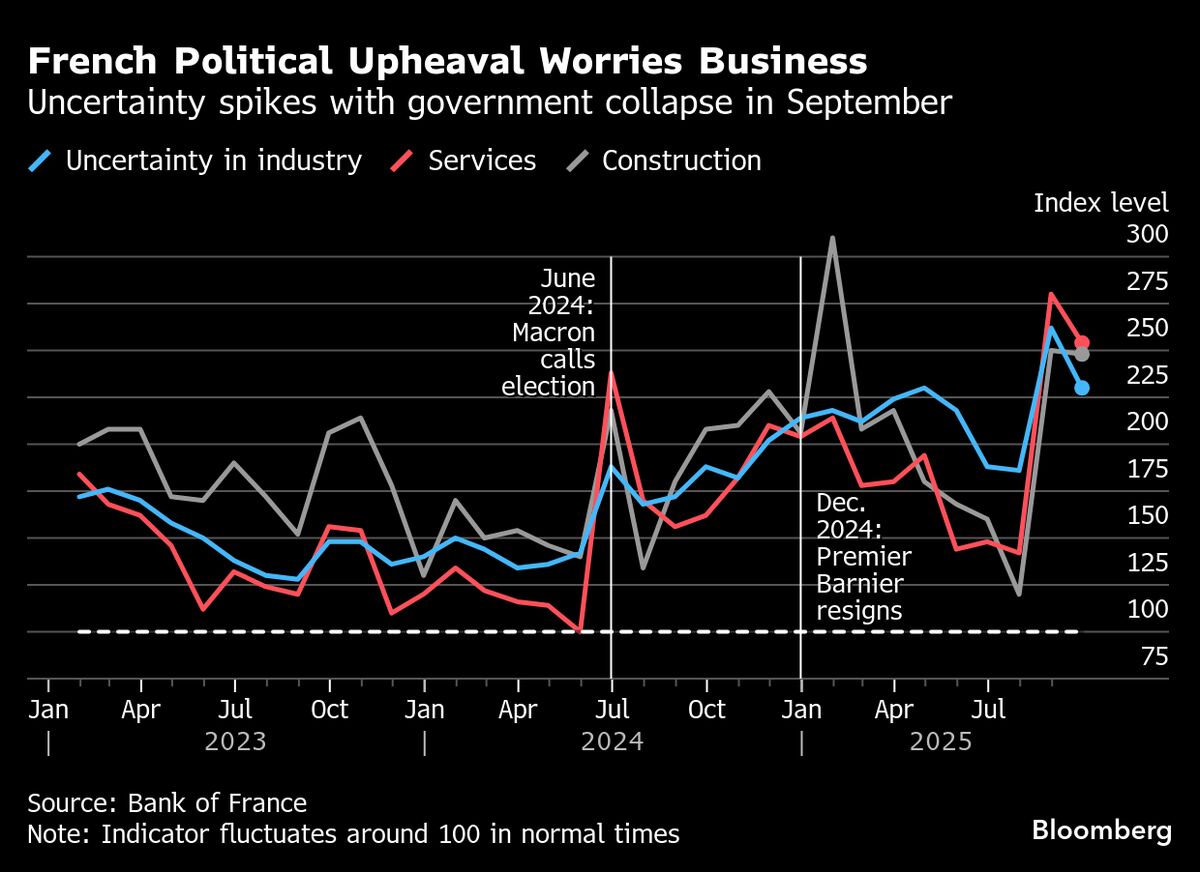

The European Central Bank is expected to maintain its current interest rates during its meeting in Florence, as it awaits year-end projections that could shed light on the impacts of trade tensions and France's fiscal challenges. With inflation hovering around the 2% target and the economy showing signs of modest growth, officials, including President Christine Lagarde, believe that the monetary policy is currently well-positioned. This decision is significant as it reflects the ECB's cautious approach amid ongoing economic uncertainties.

— Curated by the World Pulse Now AI Editorial System