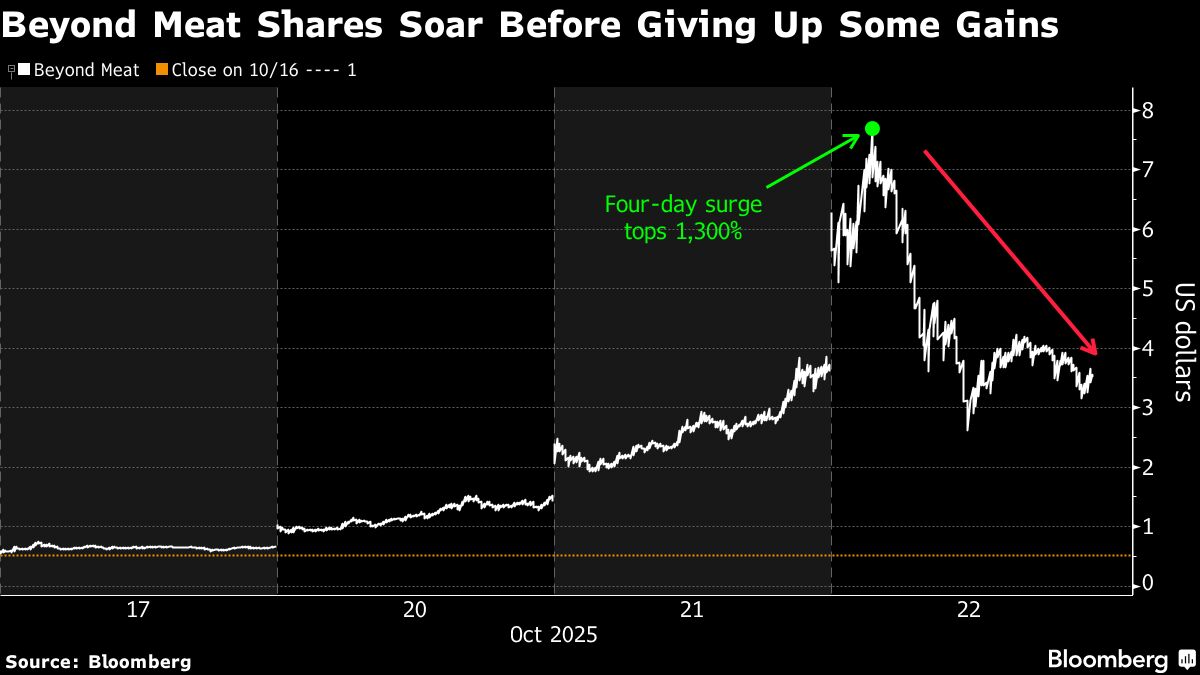

Beyond Meat Goes Meme: Traders Pile Into Struggling Faux Meat Shares

PositiveFinancial Markets

Beyond Meat has seen a remarkable turnaround this week, with its stock soaring over 450% after a trading frenzy. This surge comes on the heels of a significant drop last week due to concerns over a debt deal. The excitement among traders highlights the volatile nature of the market and the potential for quick gains, making it a noteworthy event for investors and the food industry alike.

— Curated by the World Pulse Now AI Editorial System