Hot-Money Retail Traders Turn Momentum Chasers Into Bagholders

NegativeFinancial Markets

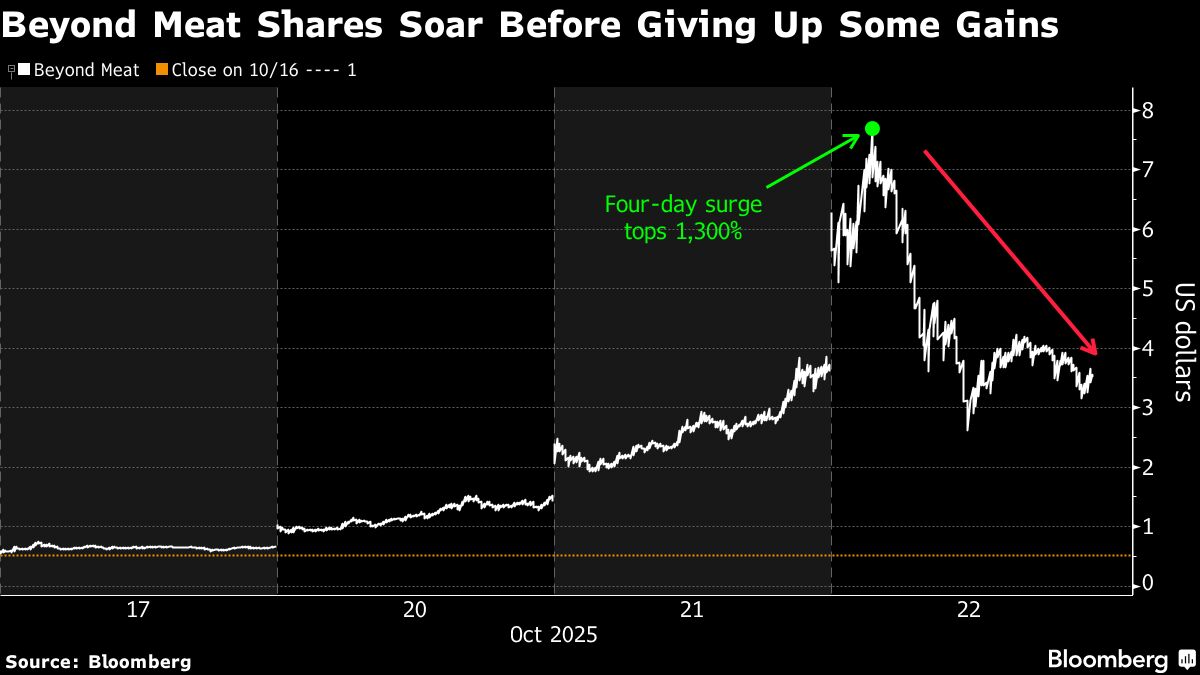

The recent surge in shares of Beyond Meat Inc. by over 1,000% has quickly turned sour, with a significant portion of those gains disappearing almost immediately. This volatility reflects broader market trends, including a record spike in gold prices followed by a severe selloff, and massive investments into risky ETFs linked to cryptocurrencies like Bitcoin and Solana. This matters because it highlights the unpredictable nature of the market, where quick gains can lead to substantial losses, impacting retail traders and investors alike.

— Curated by the World Pulse Now AI Editorial System