Trump Arrives in UK Backed by Microsoft, OpenAI Deals; TikTok US Future Latest | The Pulse 9/17/2025

PositiveFinancial Markets

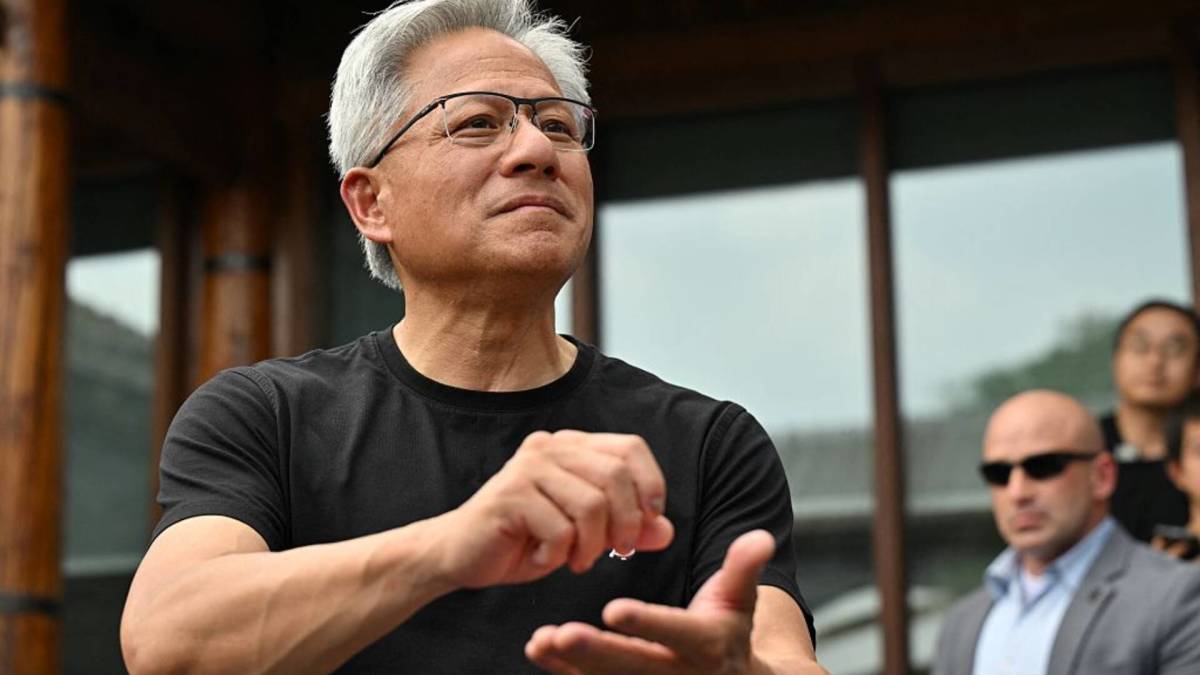

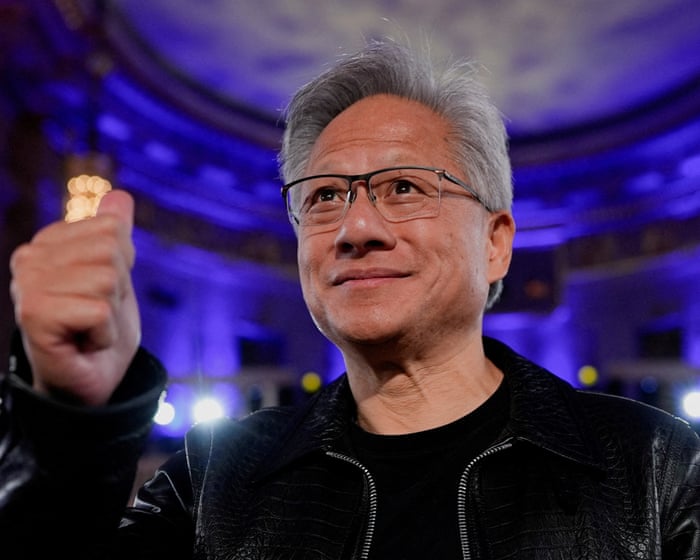

President Donald Trump's visit to the UK is marked by significant business deals involving major American tech companies like Microsoft and OpenAI, which are set to invest billions in the country's technology infrastructure. This collaboration not only highlights the strengthening ties between the US and the UK but also showcases the influence of Silicon Valley leaders, including Nvidia's Jensen Huang and OpenAI's Sam Altman. Additionally, the future of TikTok in the US is being shaped by a potential acquisition, making this visit crucial for both economic and technological advancements.

— Curated by the World Pulse Now AI Editorial System