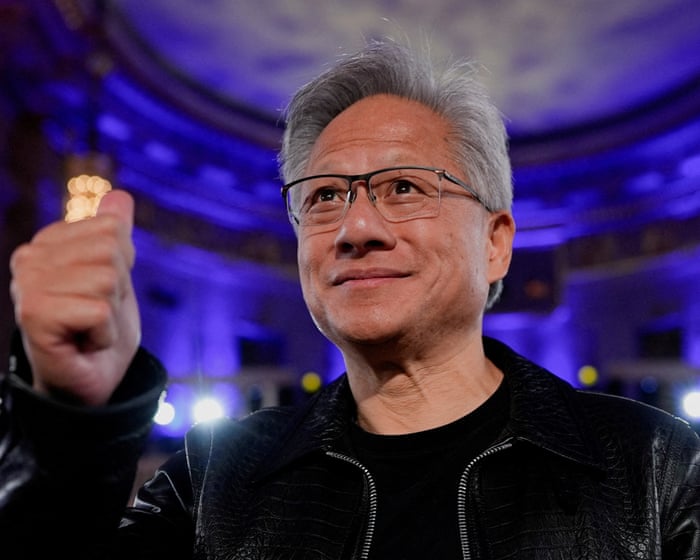

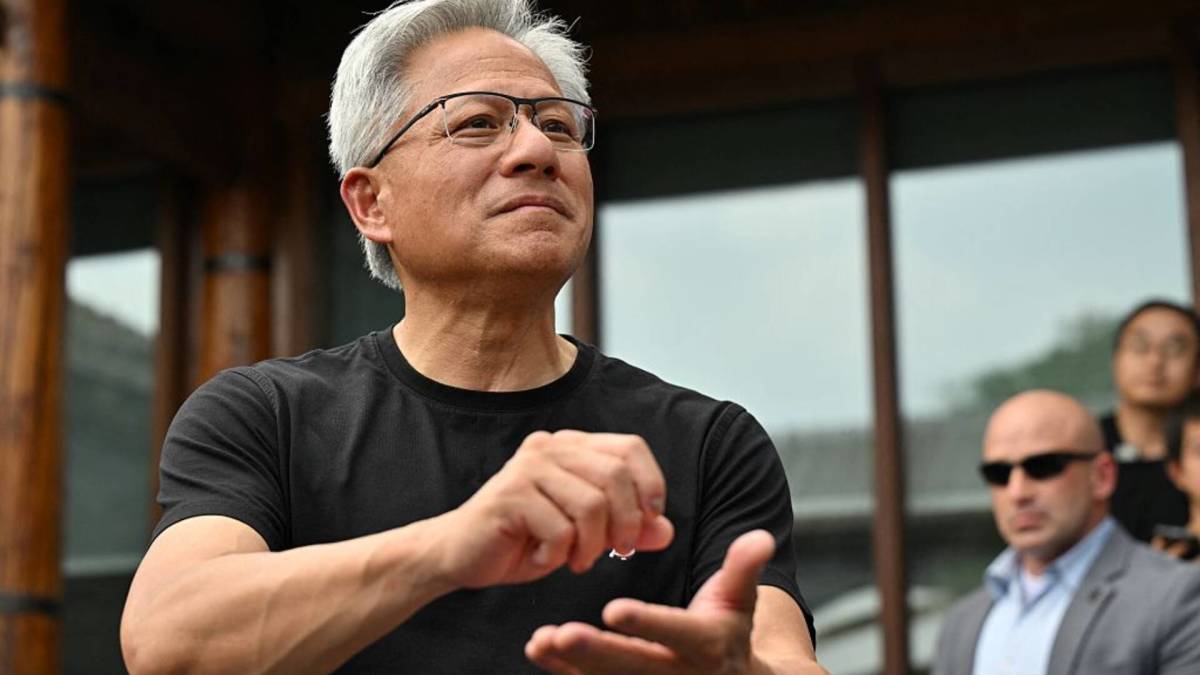

Nvidia makes biggest-ever global AI push

PositiveFinancial Markets

Nvidia is making a significant global push in artificial intelligence, which is set to redefine the next phase of the AI race. This move is crucial as it positions Nvidia at the forefront of technological advancements, potentially leading to groundbreaking innovations and applications in various sectors.

— Curated by the World Pulse Now AI Editorial System