White House tariff decree gives US auto stocks end-of-quarter bump

NeutralFinancial Markets

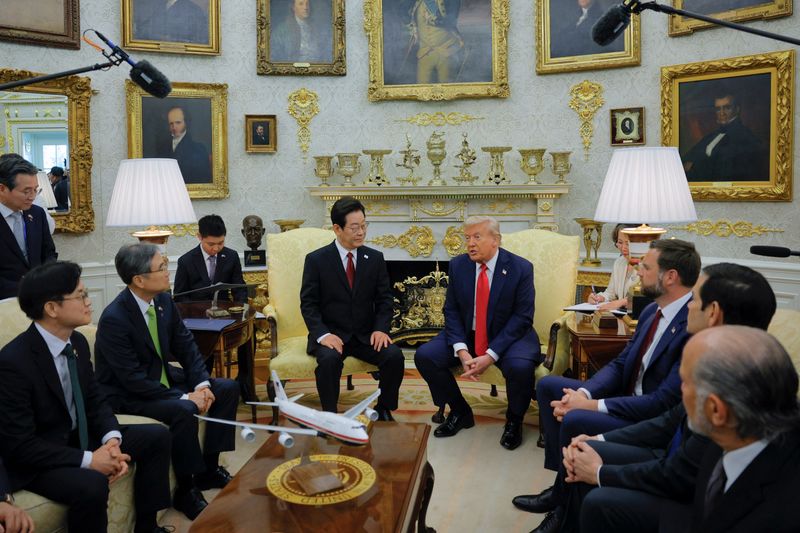

The recent tariff decree from the White House has sparked renewed discussions around the auto trade war, following President Donald Trump's announcement. This move has led to a noticeable uptick in U.S. auto stocks as investors react to the potential implications for the industry. Understanding these developments is crucial as they could influence market dynamics and trade relations moving forward.

— Curated by the World Pulse Now AI Editorial System