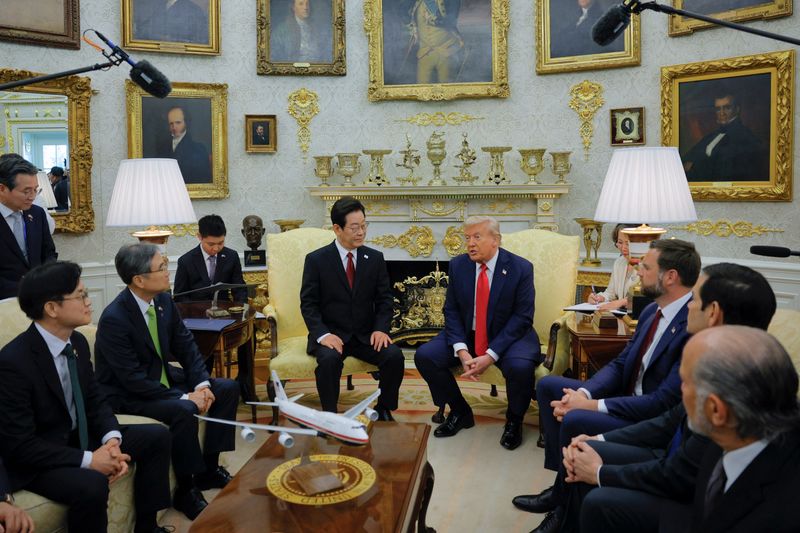

South Korea cannot pay $350 billion to US for tariff deal as Trump suggests, top aide says

NegativeFinancial Markets

South Korea's top aide has stated that the country cannot afford to pay $350 billion to the United States for a tariff deal, as suggested by former President Trump. This statement highlights the ongoing tensions between the two nations regarding trade agreements and raises concerns about the economic implications for South Korea. The inability to meet such a financial demand could strain diplomatic relations and impact future negotiations.

— Curated by the World Pulse Now AI Editorial System