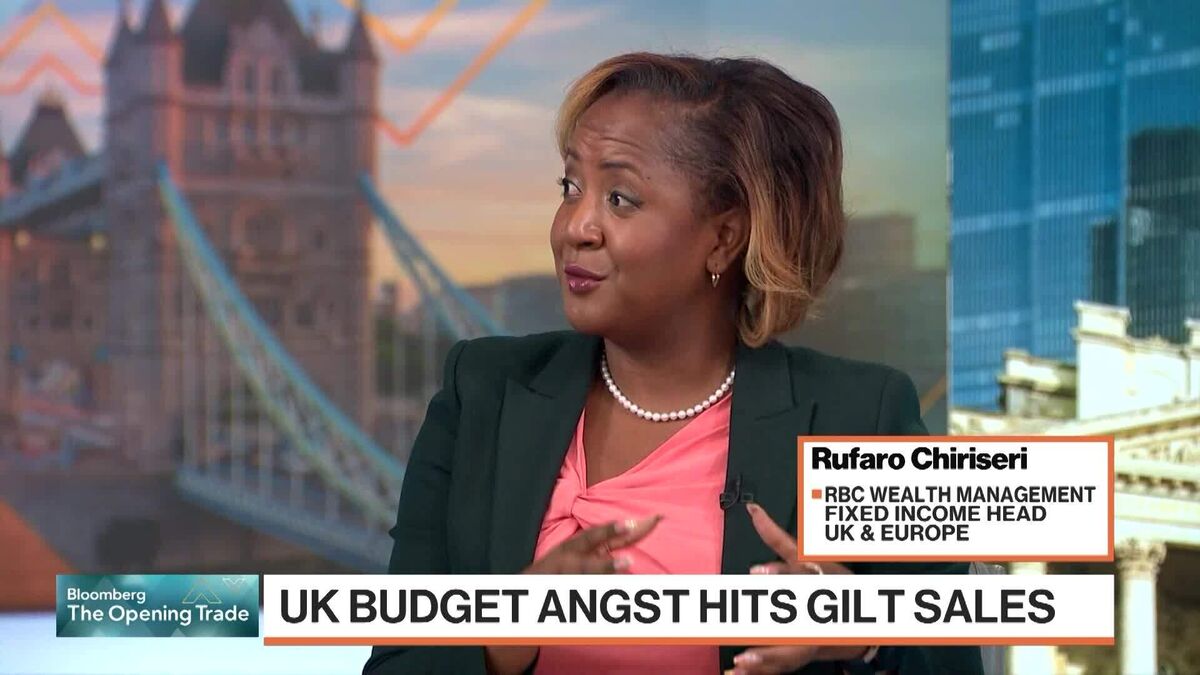

10-Year Gilt at 4.75% and Above Is Good Entry Point: RBC

PositiveFinancial Markets

Rufaro Chiriseri from RBC Europe believes that investing in 10-year gilts at a rate of 4.75% or higher presents a solid opportunity for long-term investors. With fiscal concerns surrounding the Labour Party's upcoming conference and the UK Chancellor's budget statement, this insight is particularly relevant. Chiriseri suggests that this rate provides a cushion against potential losses, making it an attractive entry point for those looking to navigate the current economic landscape.

— Curated by the World Pulse Now AI Editorial System