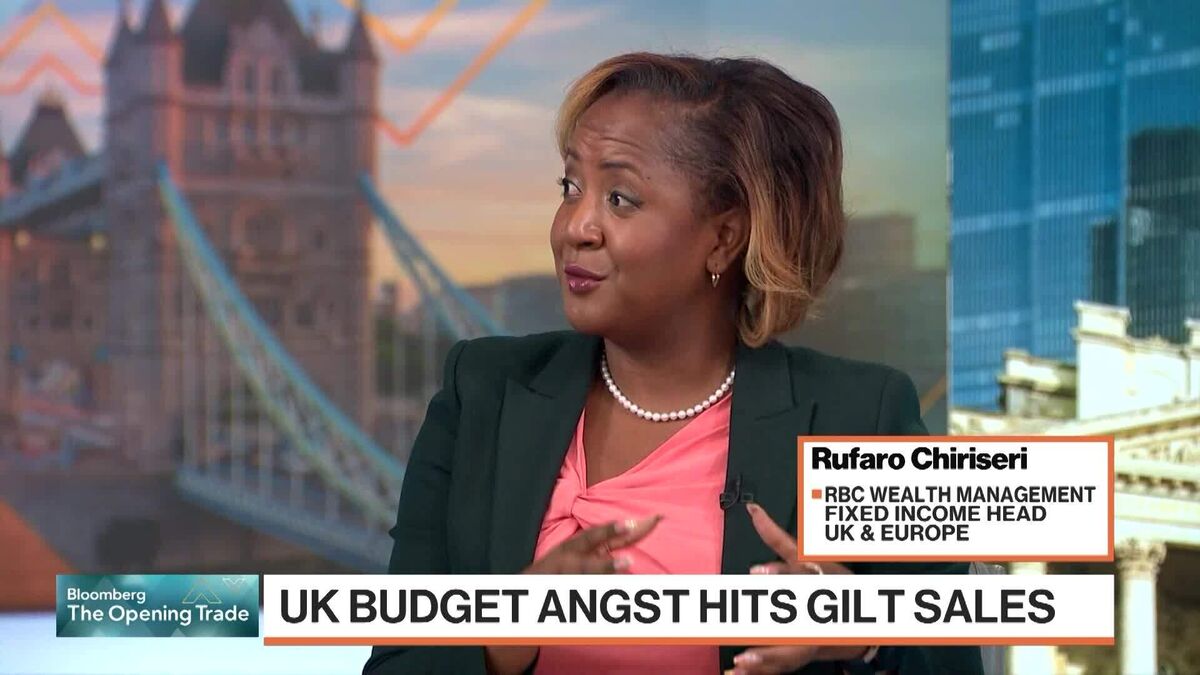

Reeves Says UK’s ‘Precarious’ Finances Require Budget Caution

NeutralFinancial Markets

Chancellor of the Exchequer Rachel Reeves has highlighted the precarious state of the UK's public finances, emphasizing the need for caution in budget management. This statement comes amid growing pressure from within the Labour Party to loosen fiscal constraints. Reeves' approach is significant as it reflects a commitment to fiscal responsibility during uncertain economic times, which could impact future government spending and public services.

— Curated by the World Pulse Now AI Editorial System