China’s Bond Traders Snap Up Treasury Bills as Liquidity Swells

PositiveFinancial Markets

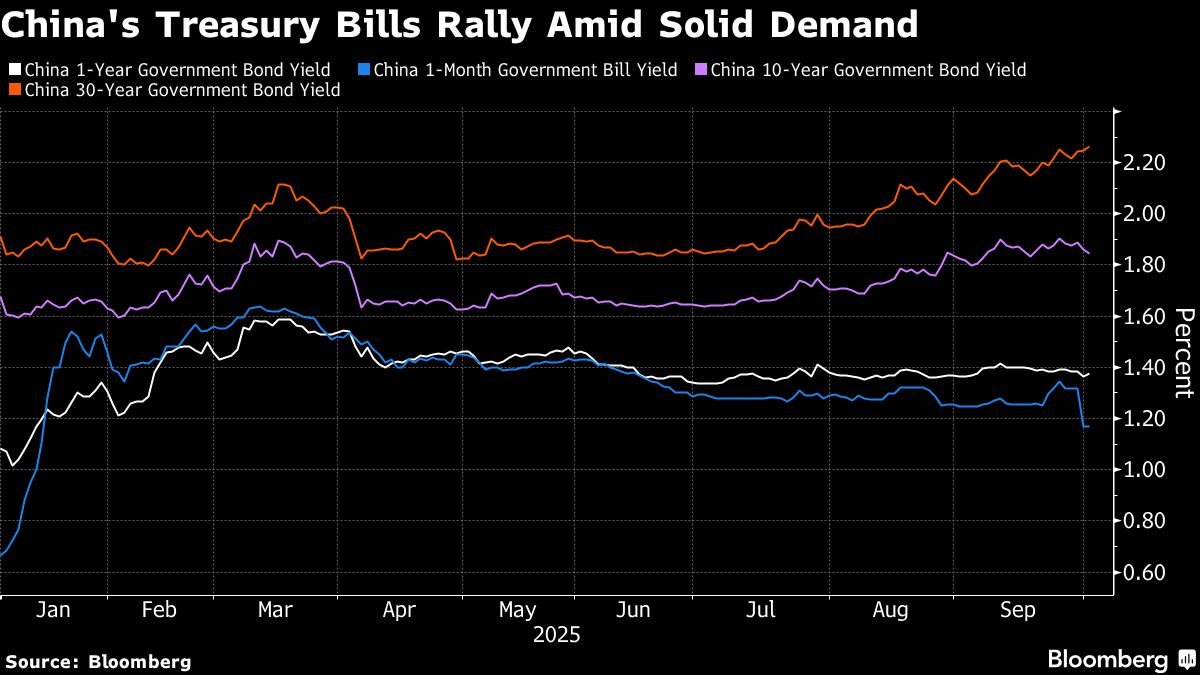

China's recent post-holiday auctions for onshore treasury bills have seen strong demand from investors, highlighting a significant increase in liquidity within the banking system. This surge in interest not only indicates confidence among investors but also suggests a healthy financial environment, which is crucial for economic stability and growth.

— Curated by the World Pulse Now AI Editorial System