Euro, yen on pace for weekly declines amid political upheavals in France, Japan

NegativeFinancial Markets

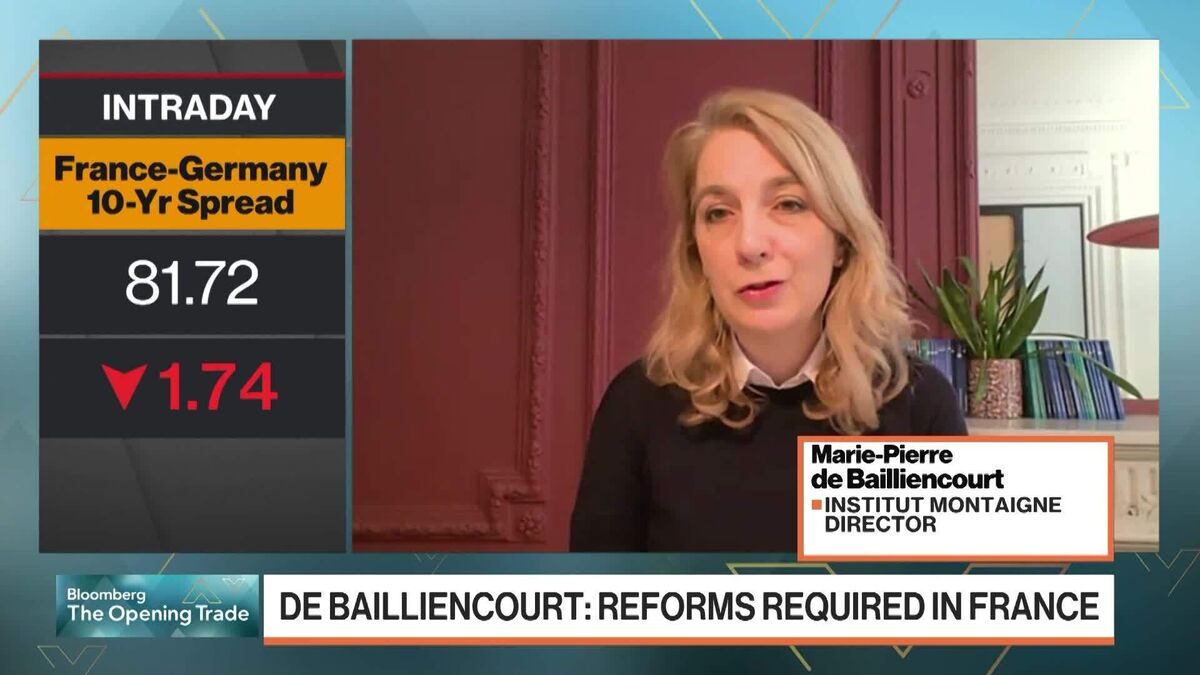

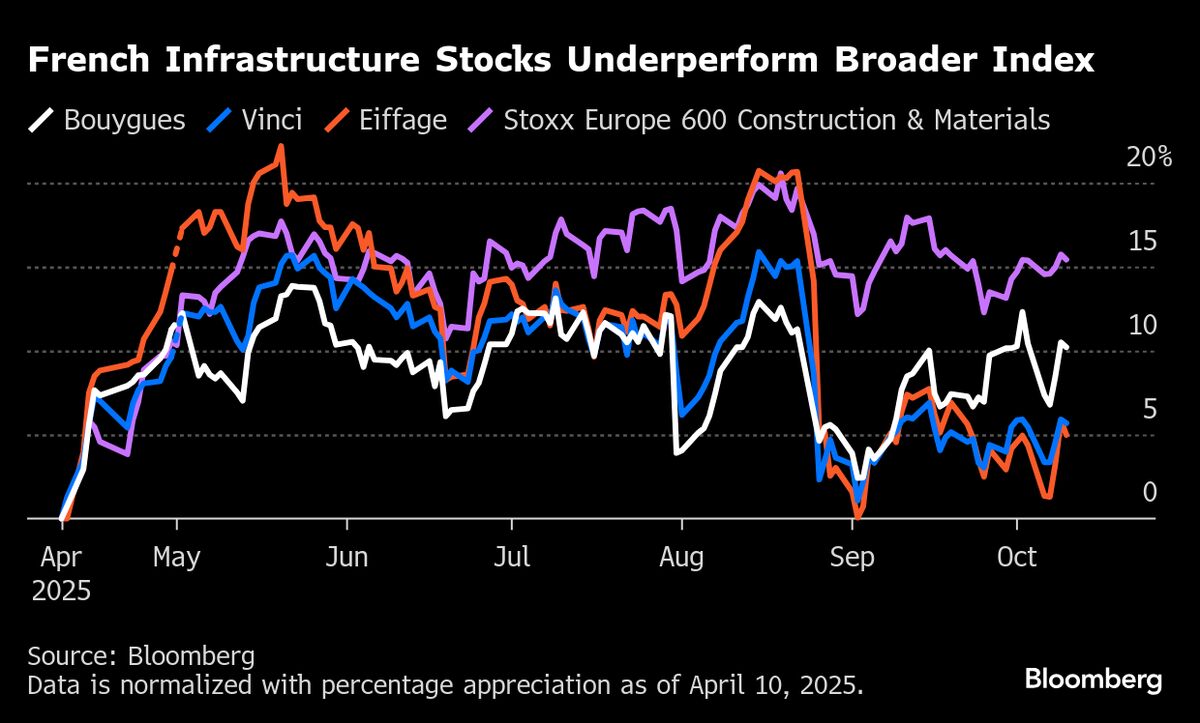

The euro and yen are facing significant declines this week, largely due to ongoing political turmoil in France and Japan. This situation is concerning as it reflects instability in these economies, which could have broader implications for global markets. Investors are closely monitoring these developments, as currency fluctuations can impact trade and investment decisions.

— Curated by the World Pulse Now AI Editorial System