Bank of America resets Amazon stock forecast after key meeting

NegativeFinancial Markets

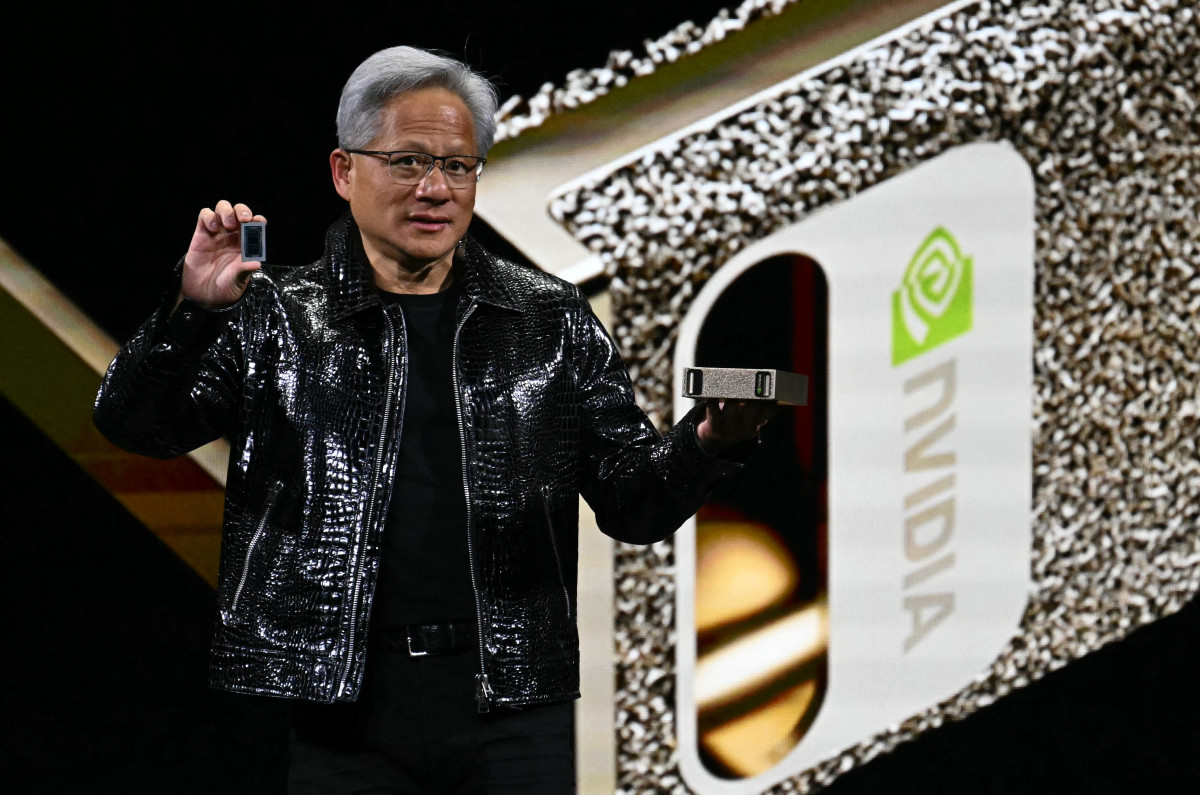

- Bank of America has revised its stock forecast for Amazon following a significant decline in the company's stock value, which has dropped approximately 8% over the past month despite a strong earnings report at the end of October. This decline is attributed to a broader sell-off affecting artificial intelligence stocks, including Nvidia, which has faced even steeper losses.

- The adjustment in Amazon's stock forecast is critical as it reflects investor sentiment and market dynamics, particularly in the tech sector, where concerns about an AI bubble are influencing stock valuations. A negative outlook from a major financial institution like Bank of America can impact investor confidence and trading behavior.

- This situation highlights ongoing volatility in the tech market, where strong earnings reports from companies like Nvidia have not alleviated fears of an AI bubble. The contrasting performance of major tech stocks, including Amazon and Nvidia, underscores a broader trend of uncertainty in the market, as investors grapple with the sustainability of recent growth in AI-related sectors.

— via World Pulse Now AI Editorial System