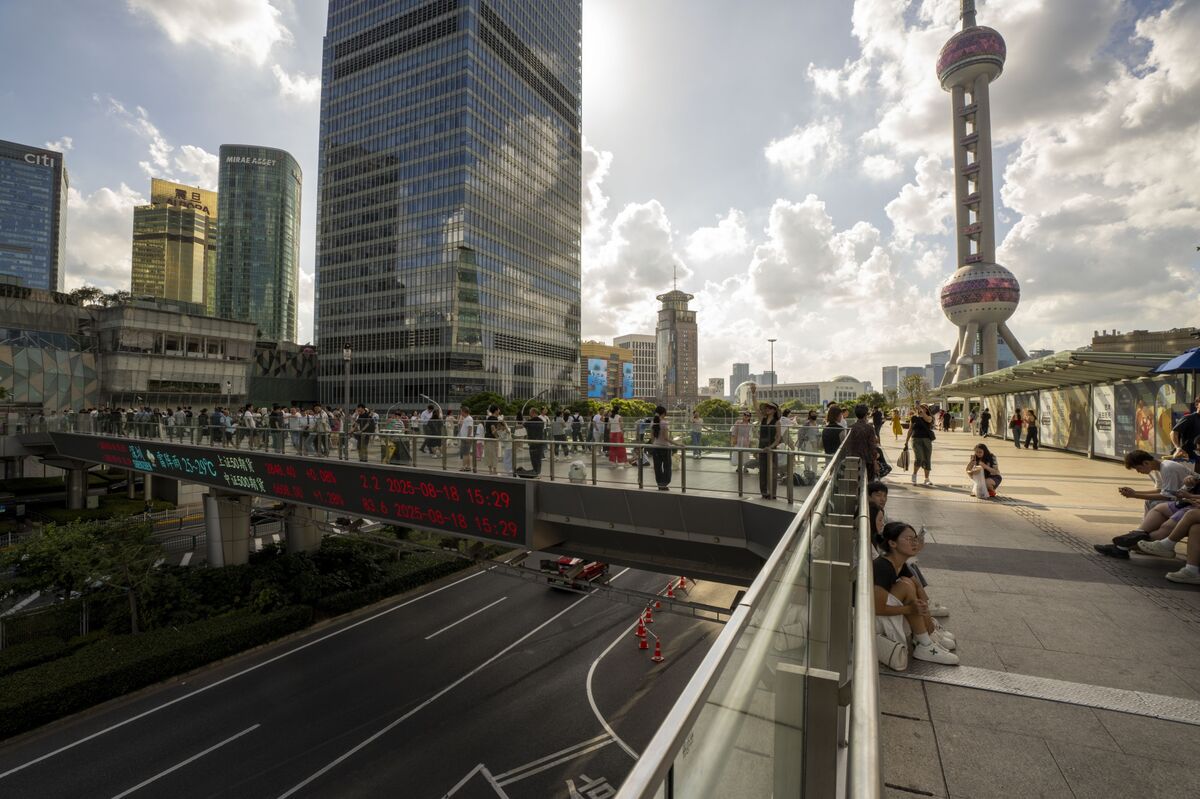

Chinese Markets Under Pressure as Xi-Trump Meet Lacks Surprises

NegativeFinancial Markets

Chinese markets are feeling the heat after a recent meeting between President Donald Trump and Xi Jinping ended without any significant breakthroughs. Investors were hoping for positive developments, but the lack of surprises has led to a pullback in Chinese stocks and a decline in the yuan. This situation matters because it reflects ongoing tensions and uncertainties in U.S.-China relations, which can have broader implications for global markets.

— Curated by the World Pulse Now AI Editorial System