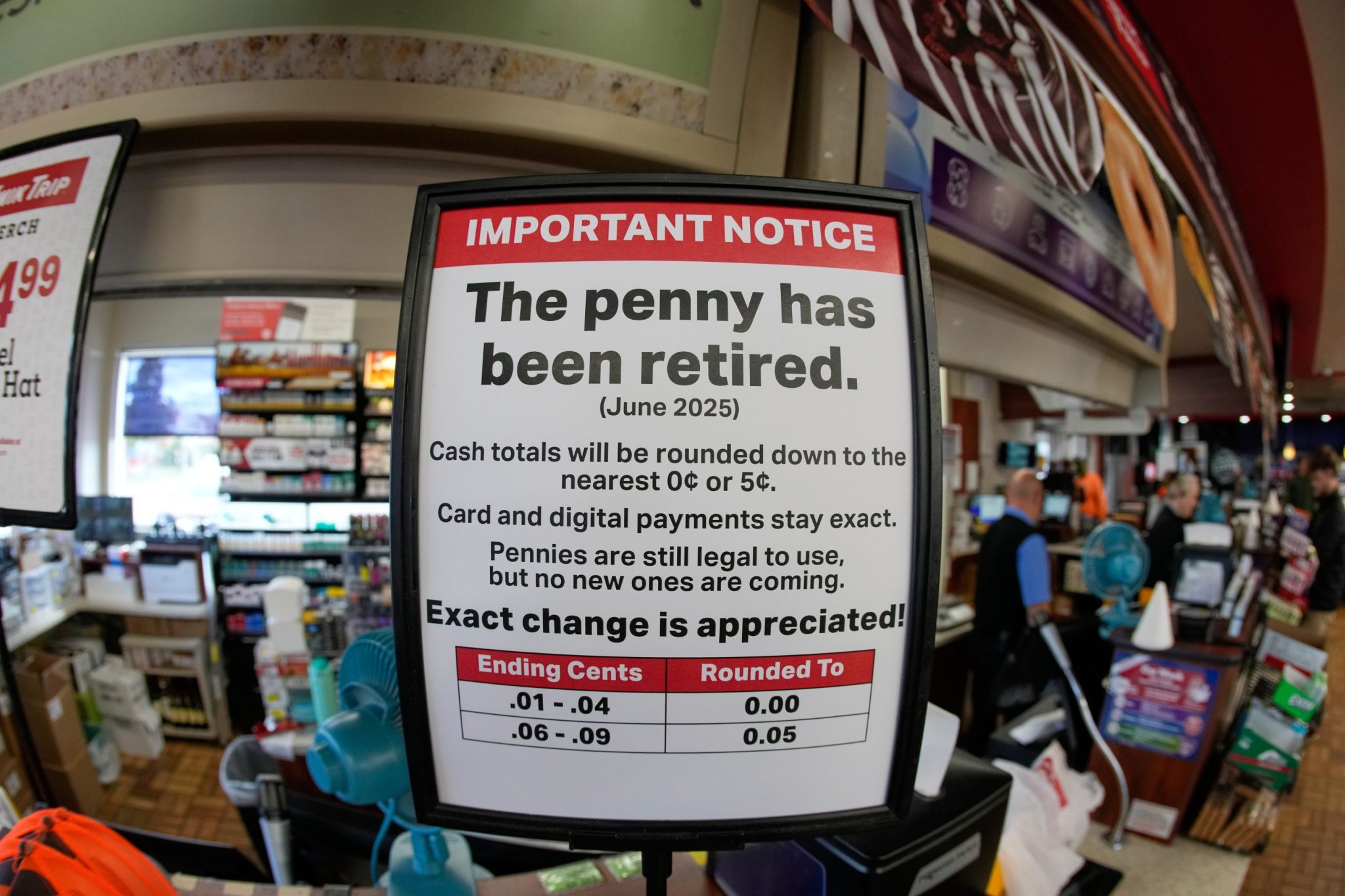

America’s officially running out of pennies — and it’s costing retailers millions

NegativeFinancial Markets

America is officially running out of pennies, and this shortage is costing retailers millions. President Donald Trump highlighted the issue on Truth Social, emphasizing the need to eliminate waste from the nation's budget, even if it starts with something as small as a penny. This situation raises concerns about the impact on everyday transactions and the broader implications for the economy.

— Curated by the World Pulse Now AI Editorial System