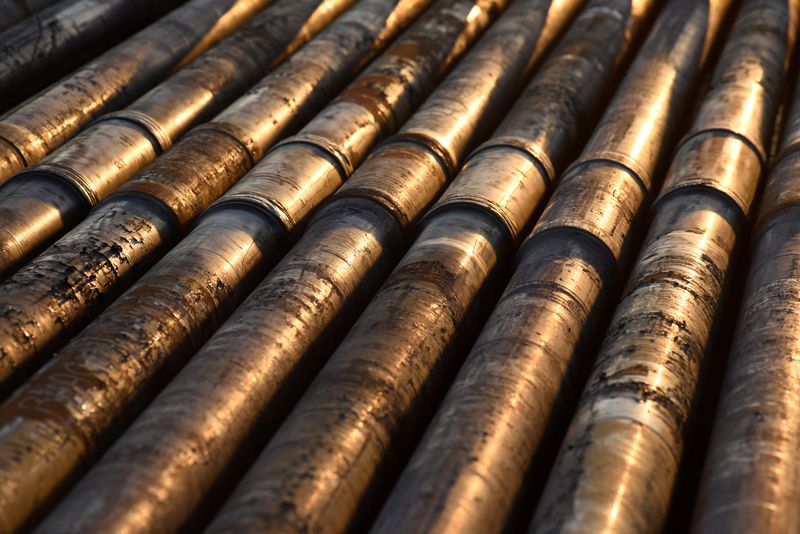

Tariffs to raise costs, delay oil and gas projects in 2026, report says

NegativeFinancial Markets

A recent report indicates that upcoming tariffs are expected to significantly increase costs and delay oil and gas projects slated for 2026. This is concerning as it could hinder energy development and impact market stability, ultimately affecting consumers and the economy.

— Curated by the World Pulse Now AI Editorial System