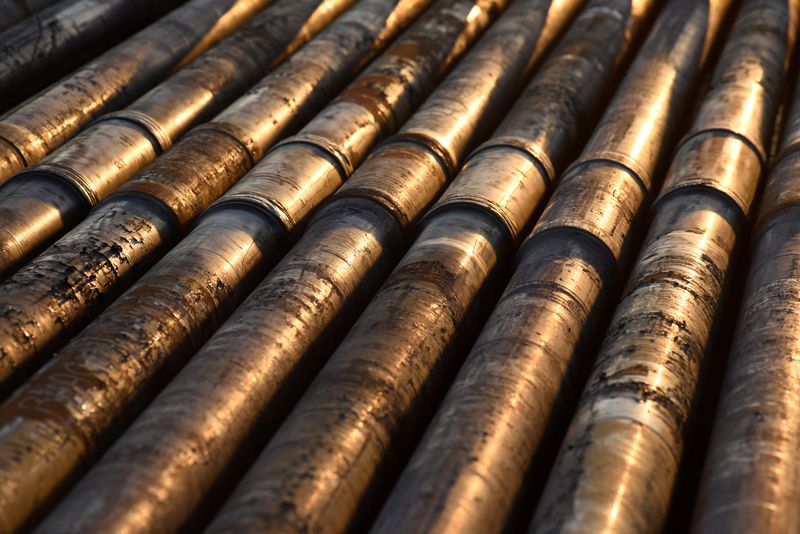

Oil dips on worries about Russian sanctions, OPEC+ output increase

NegativeFinancial Markets

Oil prices have dipped as concerns grow over potential sanctions on Russia and an increase in output from OPEC+. This situation is significant as it reflects the ongoing geopolitical tensions and their impact on global oil supply, which could lead to higher prices for consumers and affect economic stability.

— Curated by the World Pulse Now AI Editorial System