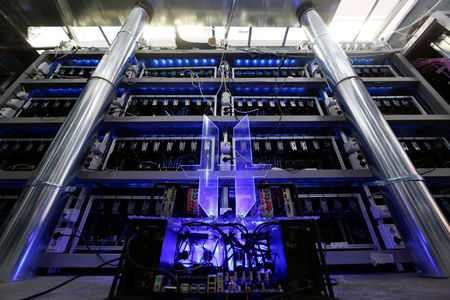

Nvidia’s $100 billion OpenAI investment raises eyebrows and a key question: How much of the AI boom is just Nvidia’s cash being recycled?

NeutralFinancial Markets

Nvidia's recent $100 billion investment in OpenAI has sparked discussions about the sustainability of the AI boom. While this investment is not a significant portion of Nvidia's overall revenues, it raises concerns reminiscent of past technology bubbles, where cash flow was recycled rather than creating genuine growth. This situation prompts a closer look at how much of the current AI excitement is driven by substantial innovation versus financial maneuvering.

— Curated by the World Pulse Now AI Editorial System