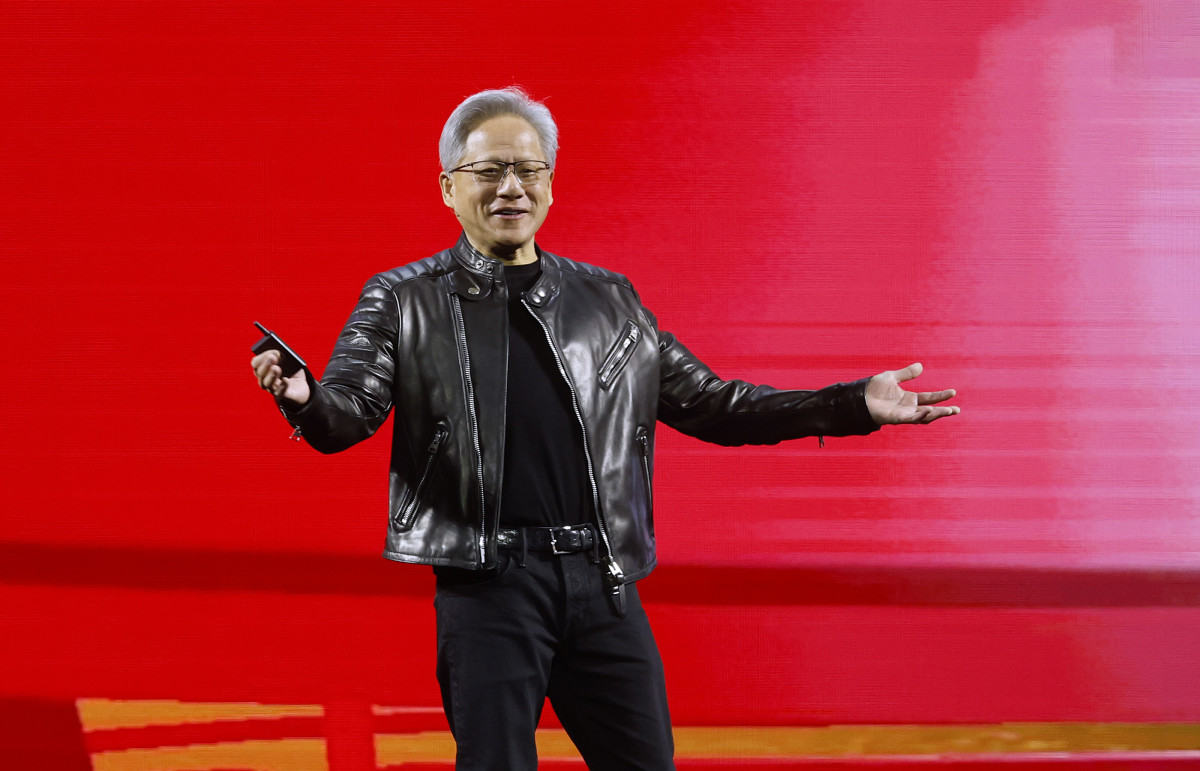

Bank of America resets Nvidia stock forecast after private meeting

NegativeFinancial Markets

- Bank of America has adjusted its stock forecast for Nvidia following a private meeting, reflecting ongoing investor concerns about the sustainability of artificial intelligence investments. This comes amid a broader market sentiment that views AI as potentially overvalued, despite some analysts' reassurances.

- The revision in Nvidia's stock forecast is significant as it indicates a shift in investor confidence, particularly in light of recent earnings reports that have not met expectations. This could impact Nvidia's market position and future growth prospects.

- The decline in Nvidia's stock is part of a larger trend affecting several companies in the AI sector, particularly Oracle, which has faced a substantial drop in its stock value due to disappointing earnings. This situation has intensified fears of an AI bubble, raising questions about the long-term viability of investments in this rapidly evolving technology.

— via World Pulse Now AI Editorial System