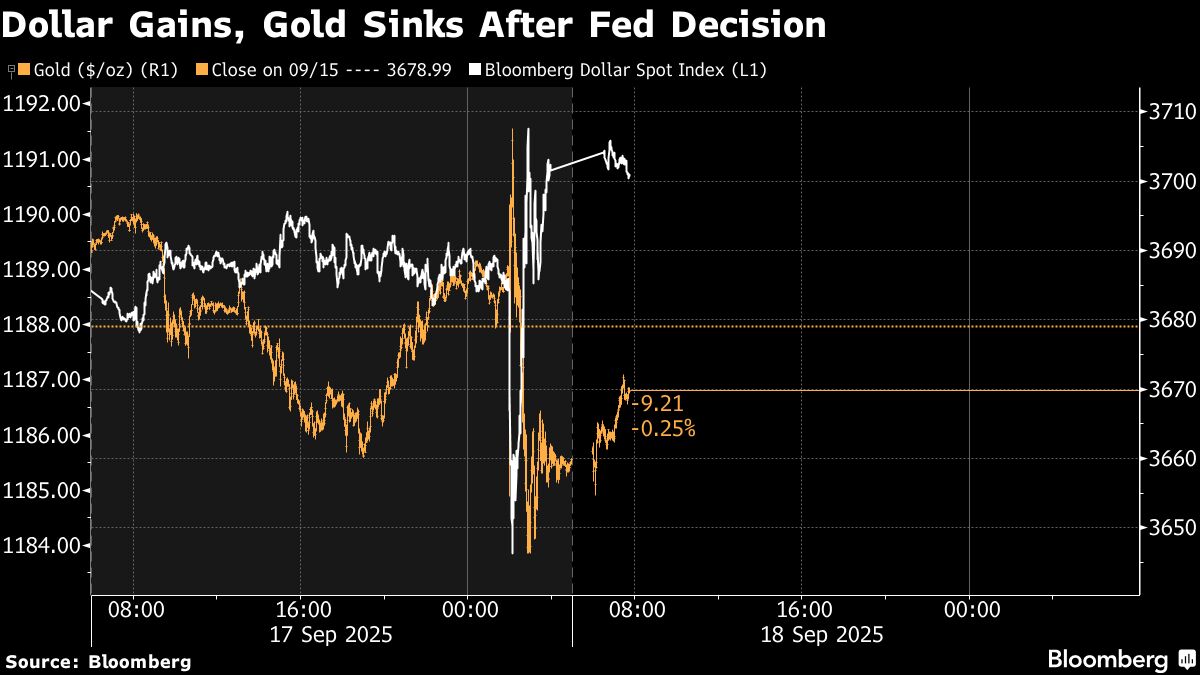

US Fed makes first rate cut of 2025 as concerns mount over jobs

NegativeFinancial Markets

The Federal Reserve has made its first interest rate cut of 2025, lowering the rate by a quarter-point to between 4.0 and 4.25 percent. This decision reflects growing concerns about the health of the labor market, with projections indicating further cuts may follow this year. This matters because it signals the Fed's response to economic pressures, which could impact borrowing costs and consumer spending.

— Curated by the World Pulse Now AI Editorial System