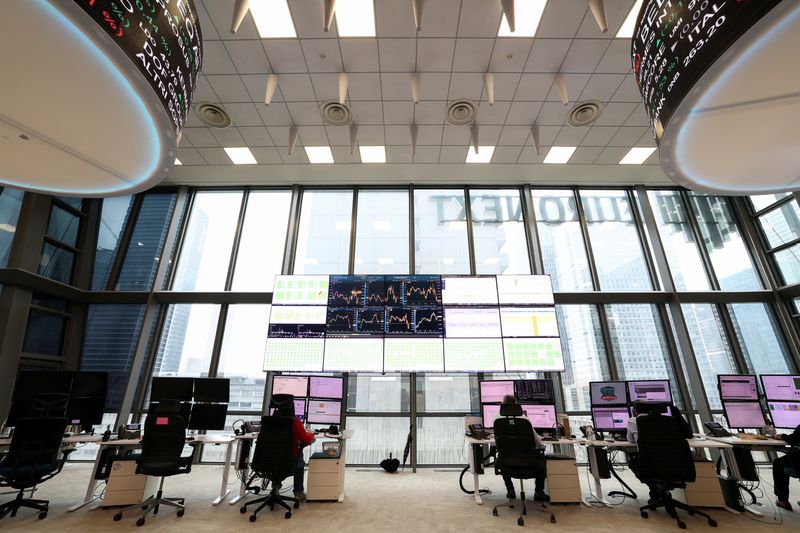

Investors see European stocks as compelling in bid to diversify

PositiveFinancial Markets

Investors are increasingly viewing European stocks as an attractive option for diversification in their portfolios. This trend highlights a growing confidence in the European market, which could lead to more capital inflow and potentially higher returns. As global economic conditions fluctuate, diversifying investments can help mitigate risks and enhance overall portfolio performance.

— Curated by the World Pulse Now AI Editorial System