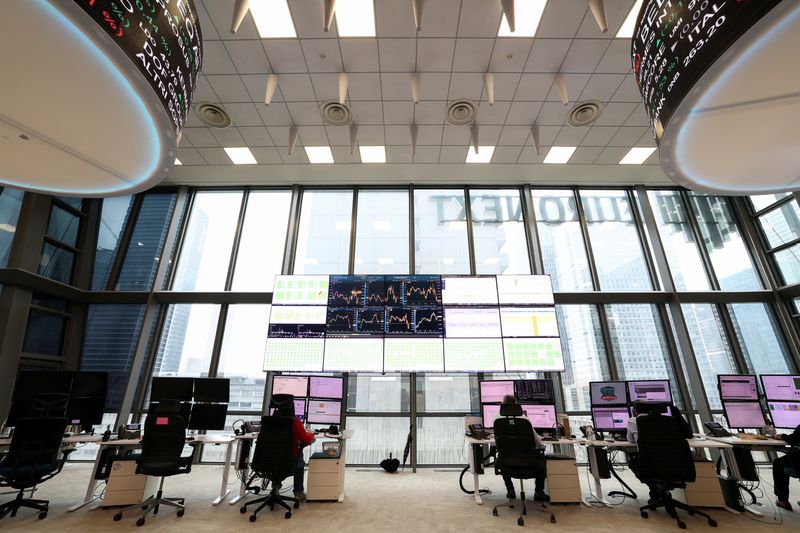

Asia stocks buoyed by AI rush, gold at fresh peaks

PositiveFinancial Markets

Asian stocks are experiencing a significant boost, driven by the ongoing excitement surrounding artificial intelligence advancements. This surge is not only uplifting the stock market but also pushing gold prices to new heights, reflecting a growing investor confidence in these sectors. As AI continues to reshape industries, the implications for economic growth and investment strategies are profound, making this a pivotal moment for both investors and the broader market.

— Curated by the World Pulse Now AI Editorial System