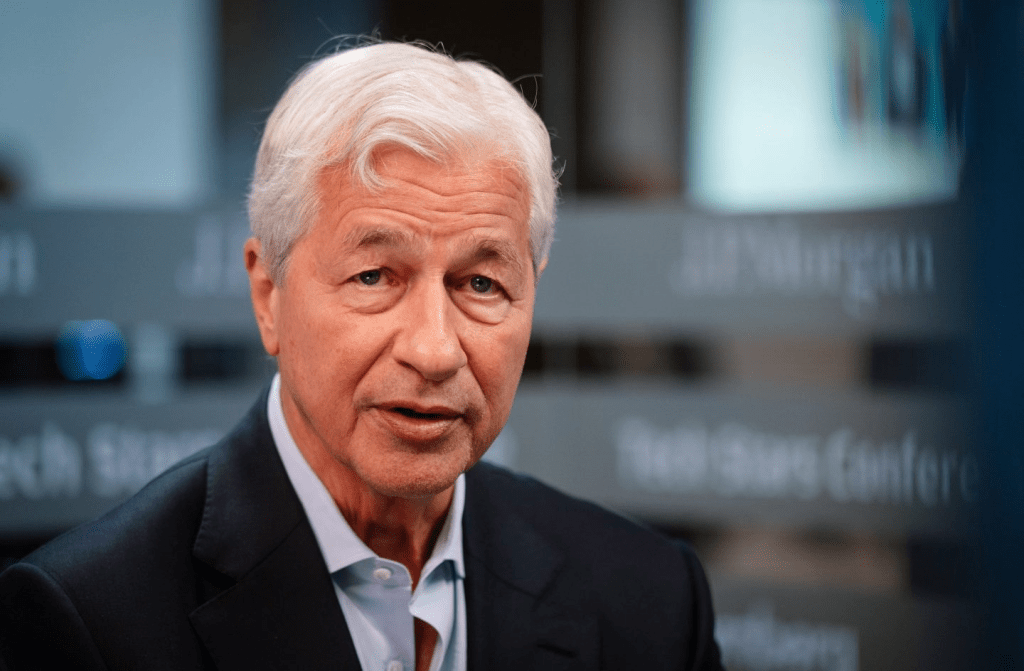

Jamie Dimon calls Zohran Mamdani’s movement ‘more Marxist than socialist,’ but he’s offering his help: ‘Get involved and grow up’

NeutralFinancial Markets

In a recent statement, JPMorgan CEO Jamie Dimon expressed his views on Zohran Mamdani's political movement, describing it as 'more Marxist than socialist.' Despite his concerns, Dimon offered his support, encouraging Mamdani to engage and mature in his approach. This exchange highlights the ongoing tension between traditional capitalism and emerging socialist ideas in American politics, emphasizing the need for reform within the capitalist system.

— Curated by the World Pulse Now AI Editorial System