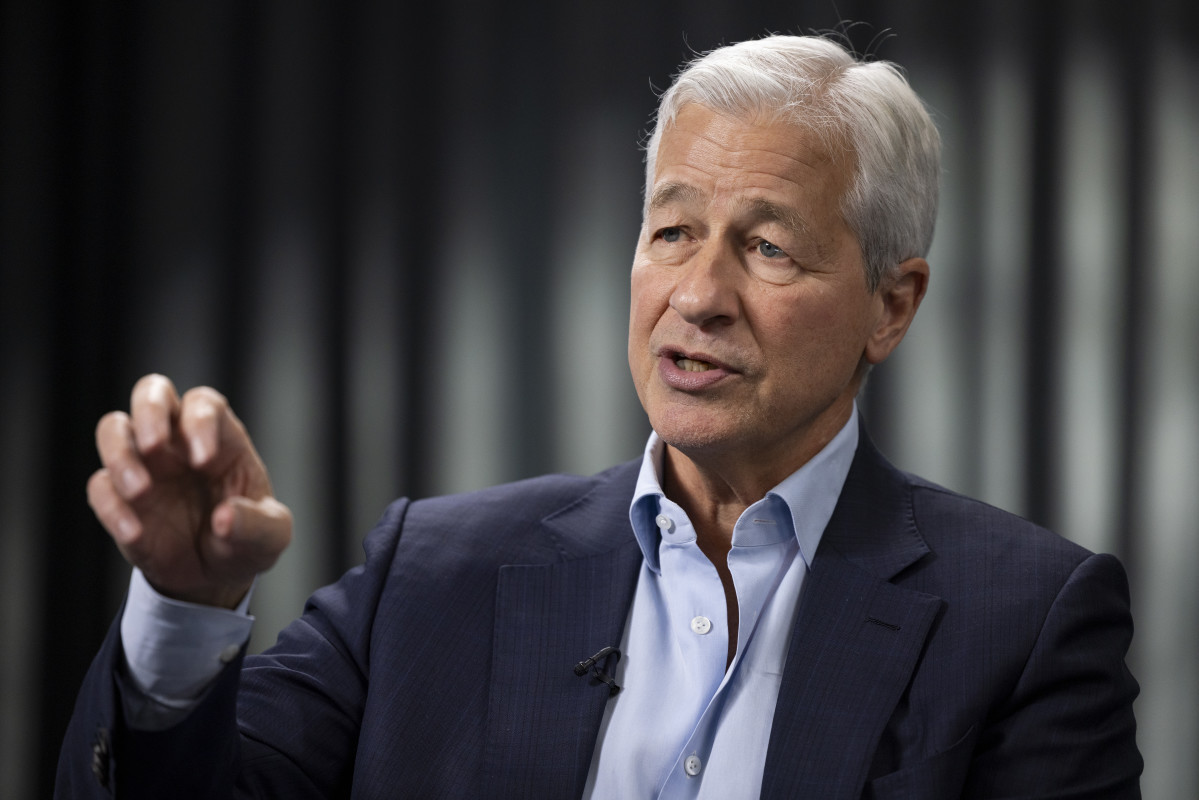

Jamie Dimon Wants Everyone in the Office. Is a $3 Billion Building the Answer?

PositiveFinancial Markets

Jamie Dimon, the CEO of JPMorgan Chase, has dedicated six years to creating a new headquarters that symbolizes a return to office life. This $3 billion skyscraper is not just a building; it's a bold statement about the importance of in-person collaboration and the revival of traditional workspaces. As companies navigate the post-pandemic landscape, Dimon's vision could inspire others to rethink their approach to office culture.

— Curated by the World Pulse Now AI Editorial System