Adler Pelzer’s Bondholders Sign NDAs as Debt Talks Step Up

PositiveFinancial Markets

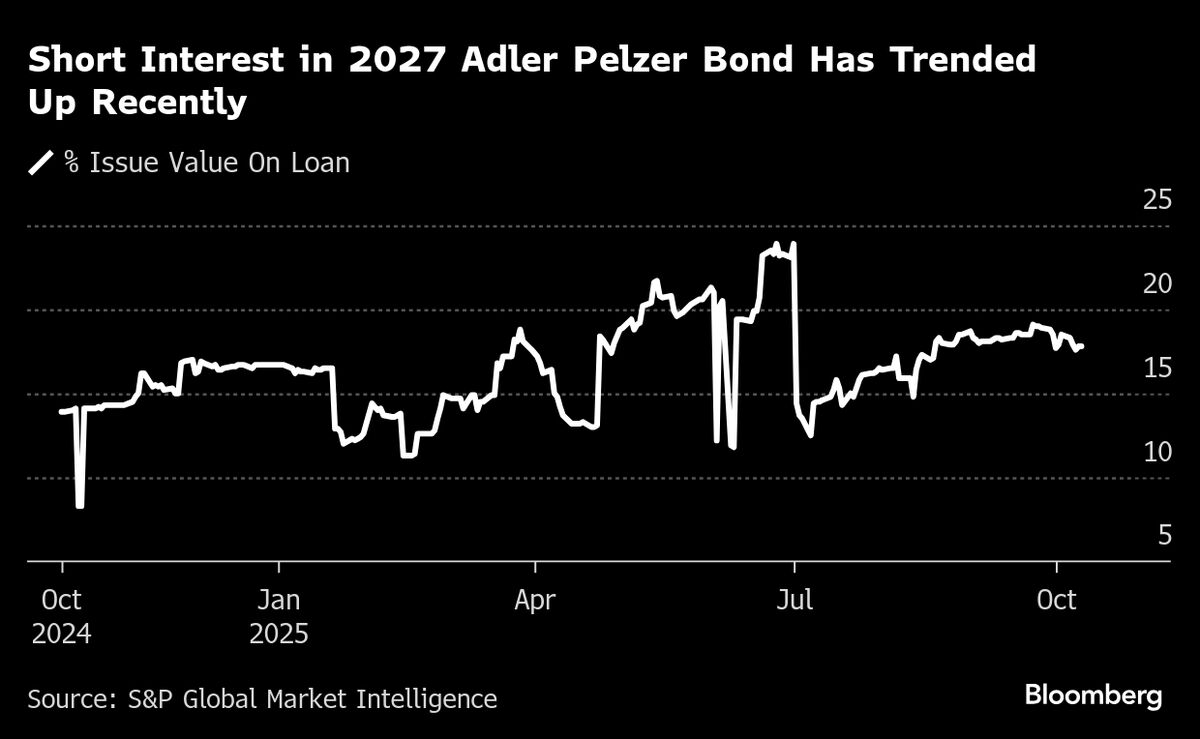

Adler Pelzer Holding GmbH is making significant progress in its debt refinancing discussions, as some bondholders have signed non-disclosure agreements. This development indicates that negotiations with creditors are intensifying, which could lead to a more stable financial future for the auto parts manufacturer. It's an encouraging sign for investors and stakeholders, suggesting that the company is taking proactive steps to manage its financial obligations.

— Curated by the World Pulse Now AI Editorial System