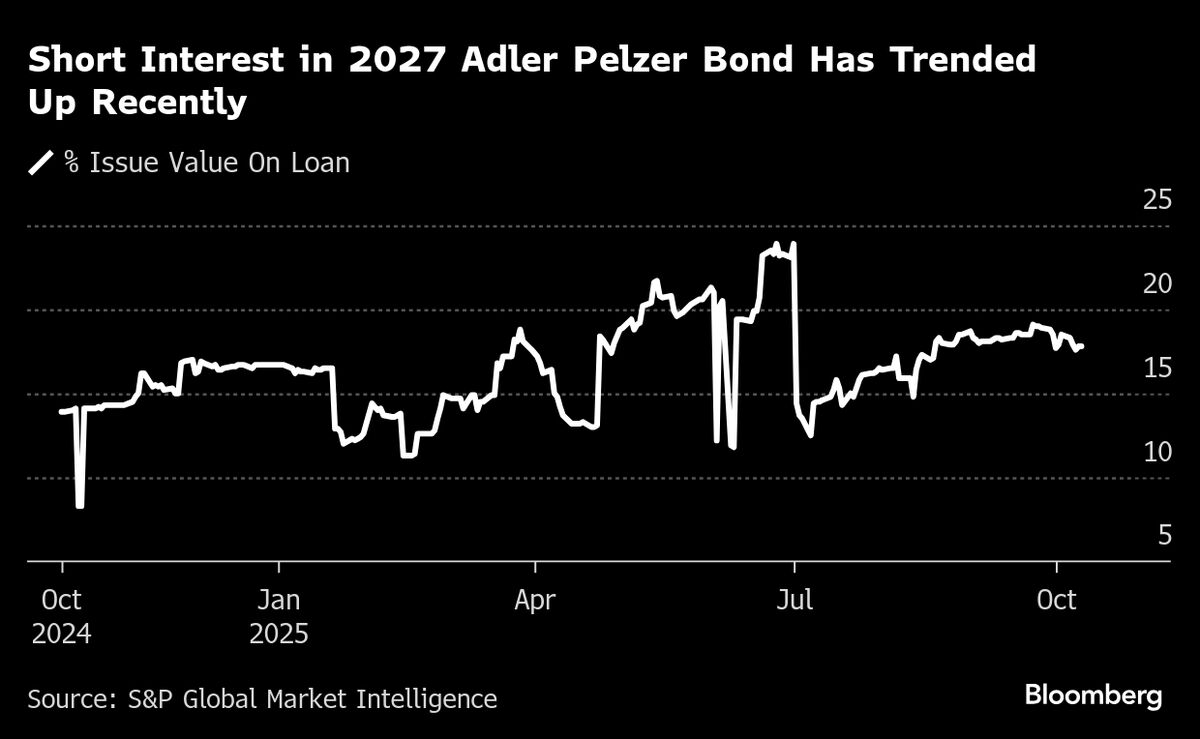

Adler Pelzer Debt Rises as Some Holders Freeze Short Sellers Out

PositiveFinancial Markets

Adler Pelzer Holding GmbH is experiencing a surge in bond prices as investors are strategically freezing out short sellers who aim to profit from a decline. This move not only reflects confidence in the company's financial stability but also highlights a proactive approach by bondholders to protect their investments. Such dynamics in the market can lead to increased investor interest and potentially more favorable conditions for the company moving forward.

— Curated by the World Pulse Now AI Editorial System