Dow Slips, Small Stocks Rally Amid Mixed Signals on Economy

NeutralFinancial Markets

- The Dow Jones Industrial Average experienced a decline, while smaller stocks showed resilience amid mixed economic signals, including rising bond yields in the U.S. and Japan and an unexpected drop in weekly American jobless claims.

- This fluctuation in the Dow highlights the ongoing volatility in the markets, reflecting investor reactions to economic indicators that could influence future monetary policy decisions and overall market sentiment.

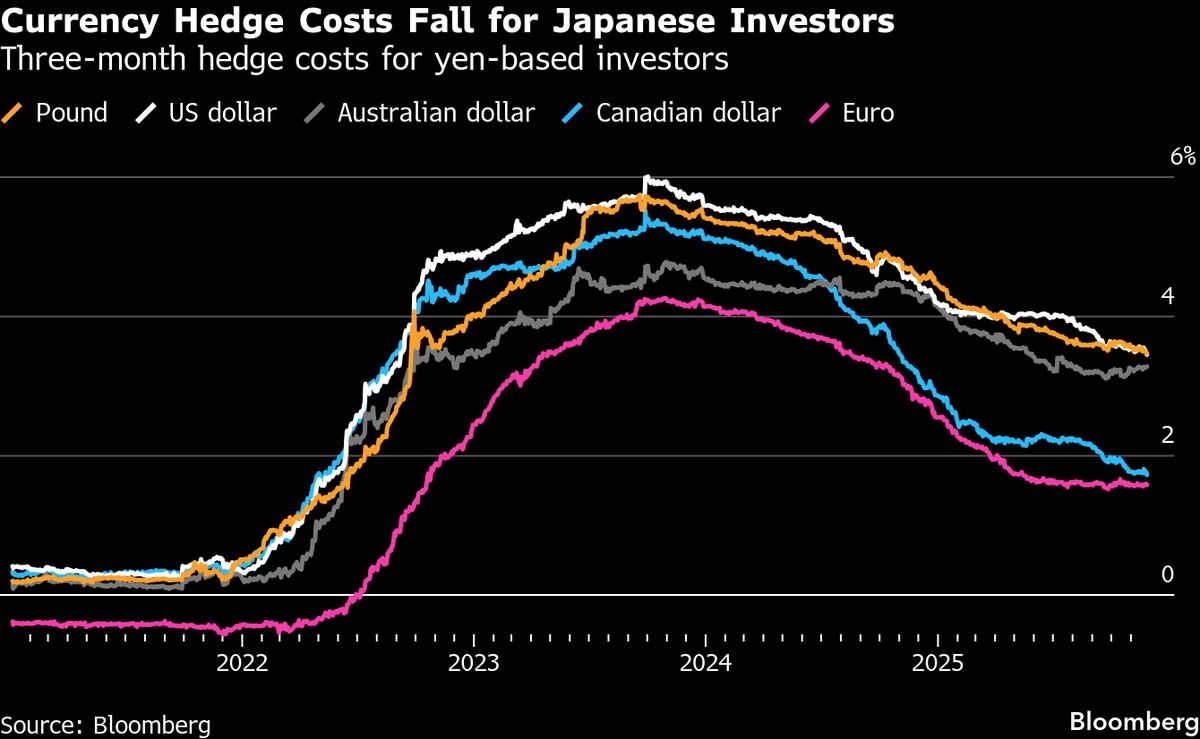

- The broader market context reveals a cautious investor sentiment, particularly regarding potential tech bubbles and economic stability in Japan, where policymakers are closely monitoring the situation as the yen weakens and concerns over fiscal policies grow.

— via World Pulse Now AI Editorial System