U.S. Futures, Global Markets Mixed; U.S. Jobs Data Eyed

NeutralFinancial Markets

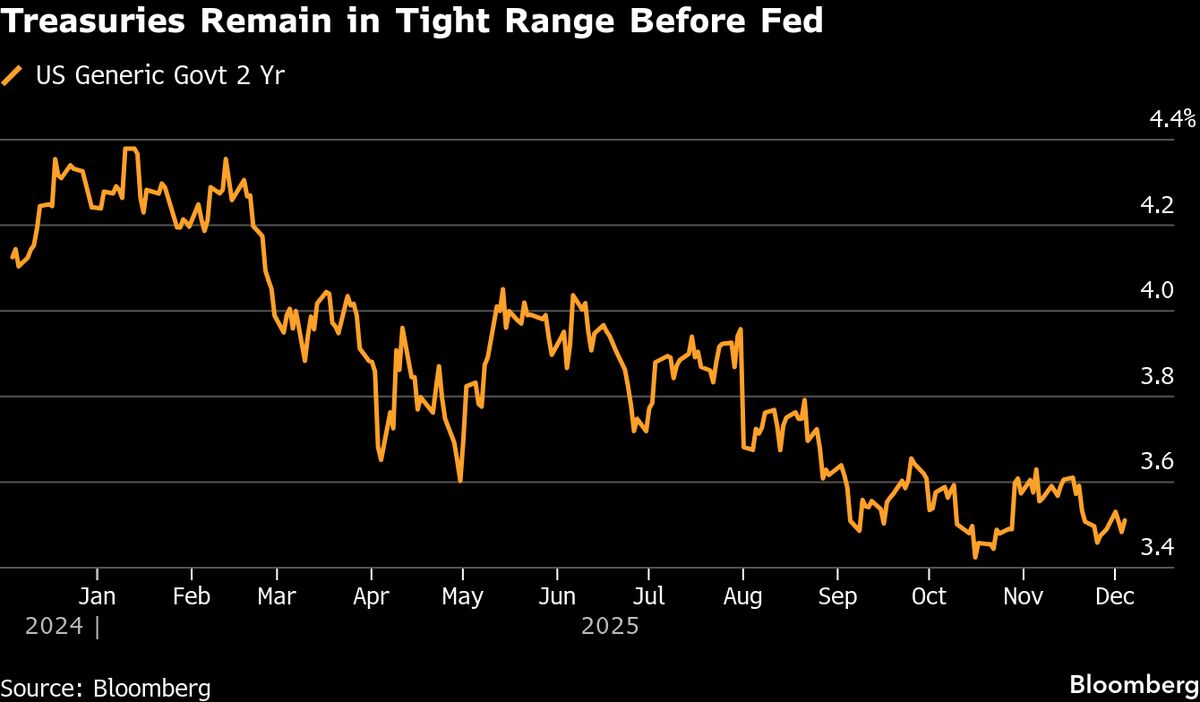

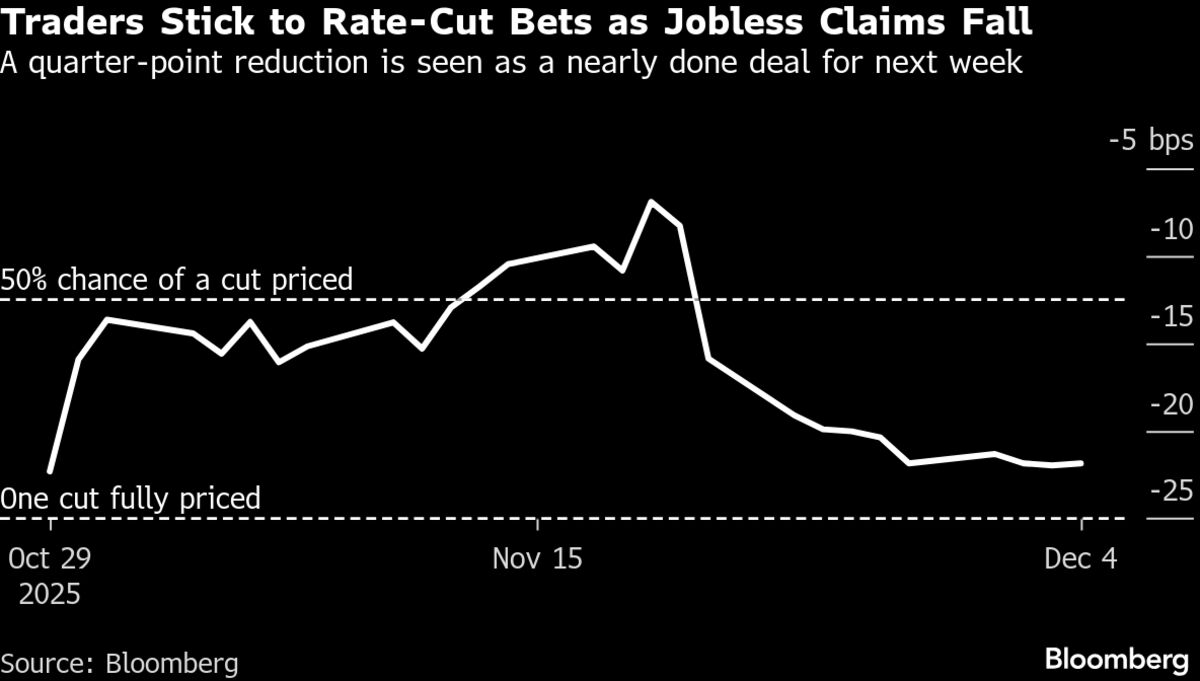

- U.S. futures and global markets are showing mixed signals as investors await the release of federal jobless claims data, which is expected to provide insights into the U.S. employment landscape ahead of the Federal Reserve's upcoming decision on interest rates.

- The jobless claims data is crucial as it may influence the Federal Reserve's monetary policy, particularly regarding potential interest rate cuts, which could have significant implications for economic growth and market stability.

- This situation reflects broader economic uncertainties, with recent job data contributing to fluctuating market sentiments, as seen in the performance of U.S. stocks and commodities like silver, which are closely tied to expectations of Federal Reserve actions.

— via World Pulse Now AI Editorial System