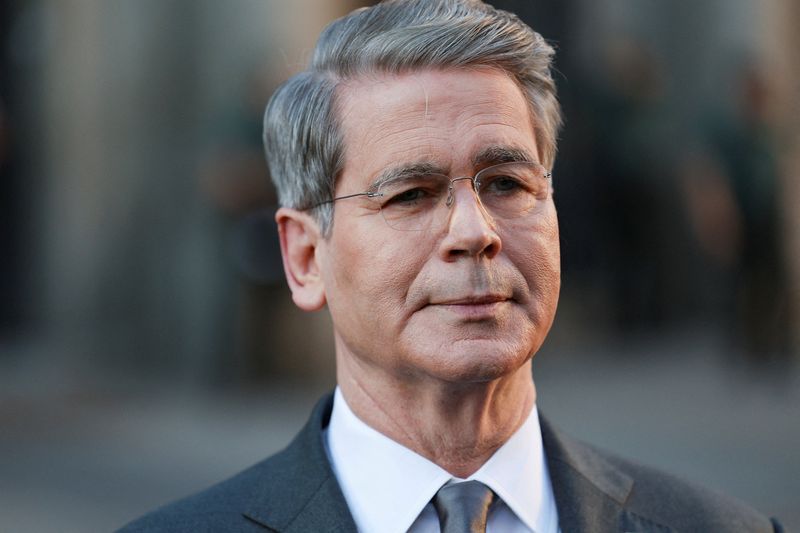

IMF proposes appointment of Bessent’s chief of staff to No. 2 post

PositiveFinancial Markets

The International Monetary Fund (IMF) has proposed the appointment of Bessent’s chief of staff to a significant No. 2 position within the organization. This move is seen as a strategic decision that could enhance leadership and operational efficiency at the IMF, especially in light of ongoing global economic challenges. The appointment reflects the IMF's commitment to strengthening its leadership team with experienced professionals who can navigate complex financial landscapes.

— Curated by the World Pulse Now AI Editorial System