S&P 500, Nasdaq, Dow and Russell 2000 Hit Record

PositiveFinancial Markets

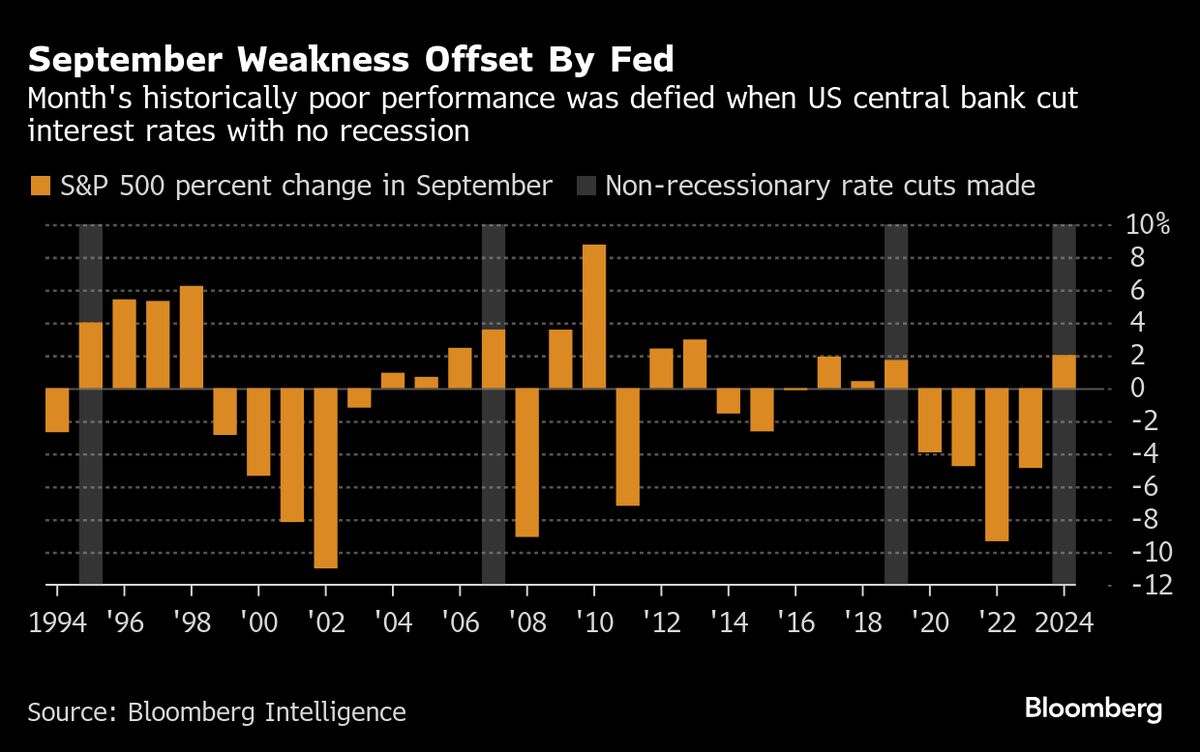

Wall Street is celebrating as the S&P 500, Nasdaq, Dow, and Russell 2000 have all hit record highs, fueled by optimism over potential Federal Reserve rate cuts. This surge reflects traders' confidence in Corporate America's resilience and growth prospects. In a recent discussion on Bloomberg Businessweek Radio, Aaron Kennon, CEO of Clear Harbor Asset Management, shared insights on what this means for investors and the sustainability of this upward trend in equities. It's an exciting time for the market, and many are eager to see how long this momentum can last.

— Curated by the World Pulse Now AI Editorial System