RBA's Hunter on Australia Economy, Inflation

NeutralFinancial Markets

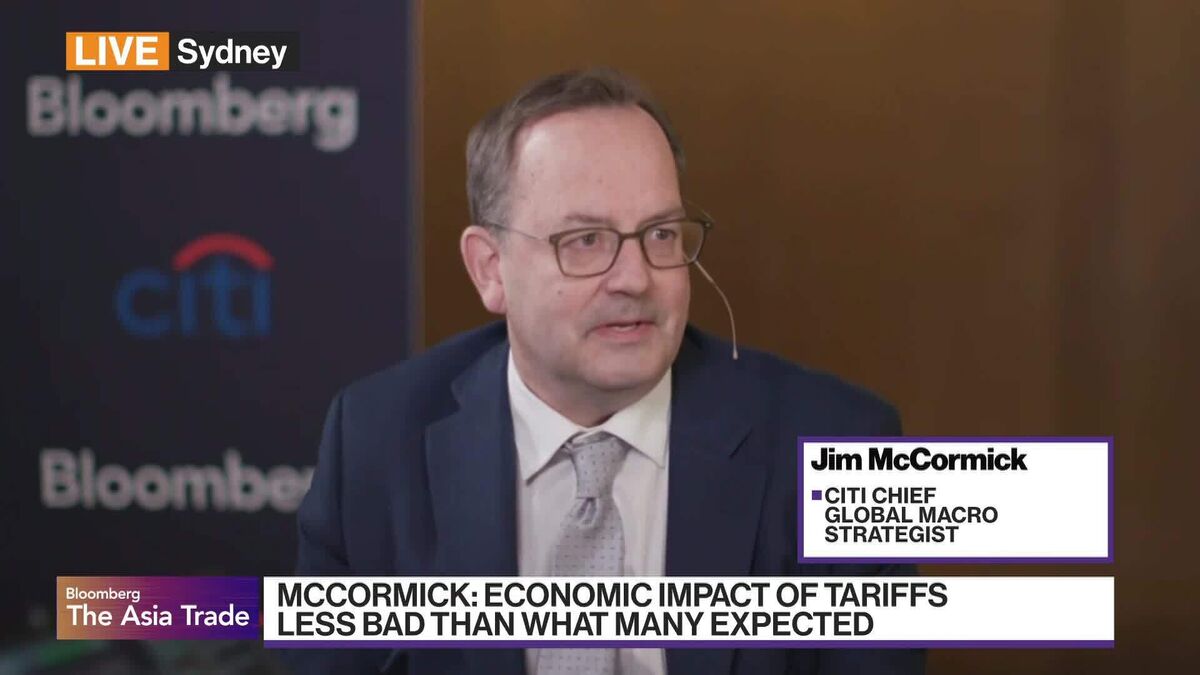

Sarah Hunter, the Chief Economist and Assistant Governor at the Reserve Bank of Australia, recently shared insights on the country's economic outlook and inflation during an interview with Paul Allen at the Citi Australia & New Zealand Investment Conference in Sydney. This discussion is significant as it provides a glimpse into the RBA's perspective on economic trends, which can influence policy decisions and market expectations.

— Curated by the World Pulse Now AI Editorial System