Verisure targets up to $16.27 billion valuation in largest European IPO since 2022

PositiveFinancial Markets

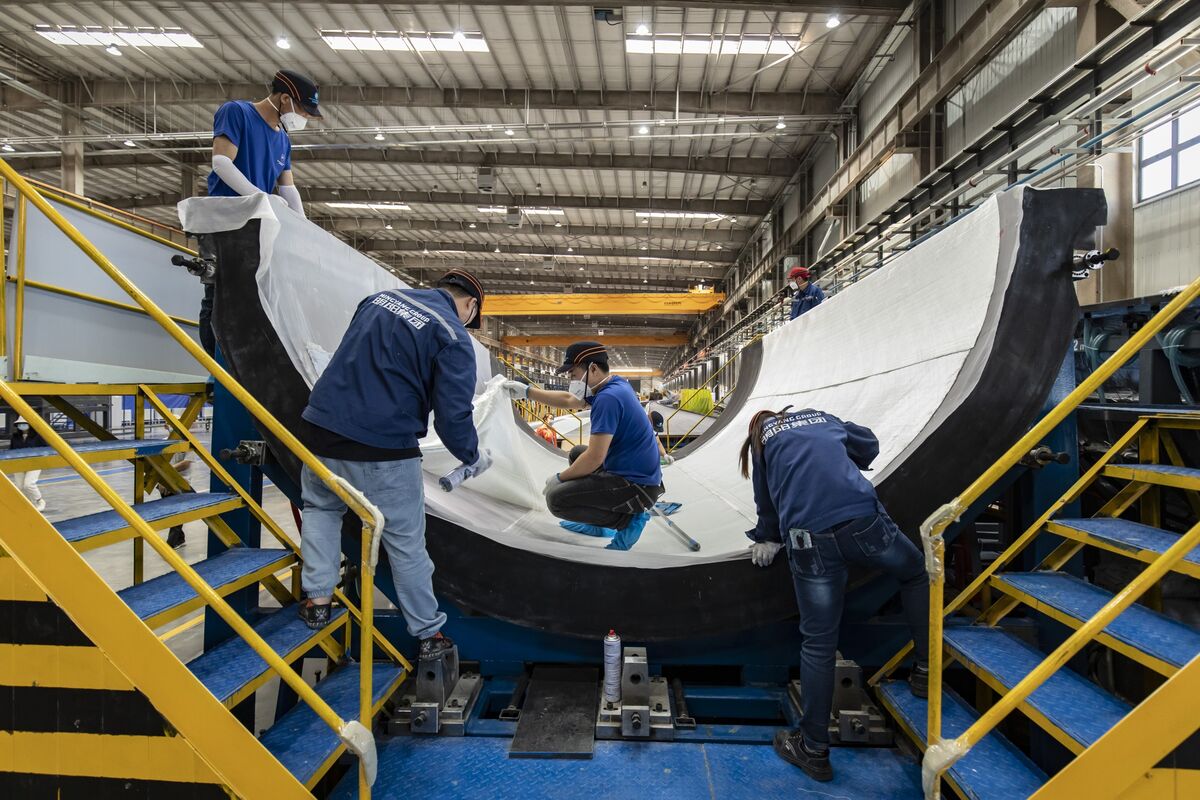

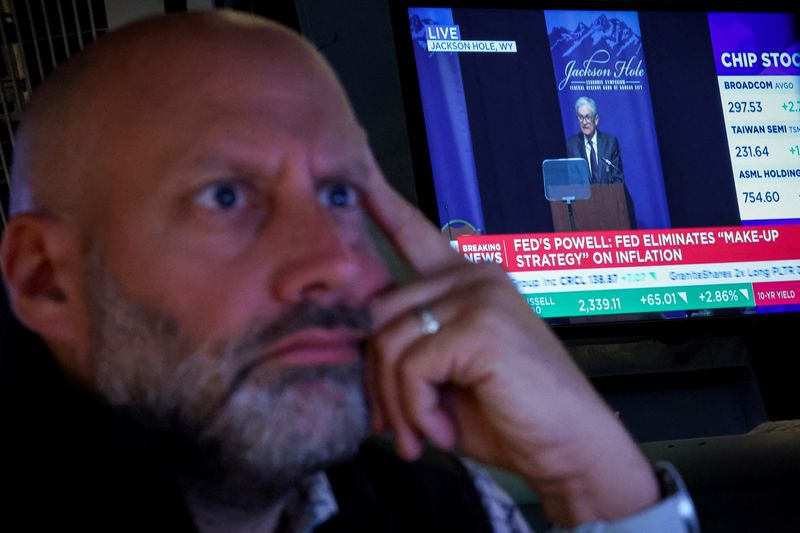

Verisure is aiming for a remarkable valuation of up to $16.27 billion in what is set to be the largest European IPO since 2022. This move not only highlights the company's growth potential but also signals a resurgence in the European stock market, attracting investor interest and confidence. As the market rebounds, Verisure's IPO could pave the way for more companies to follow suit, revitalizing the financial landscape.

— Curated by the World Pulse Now AI Editorial System