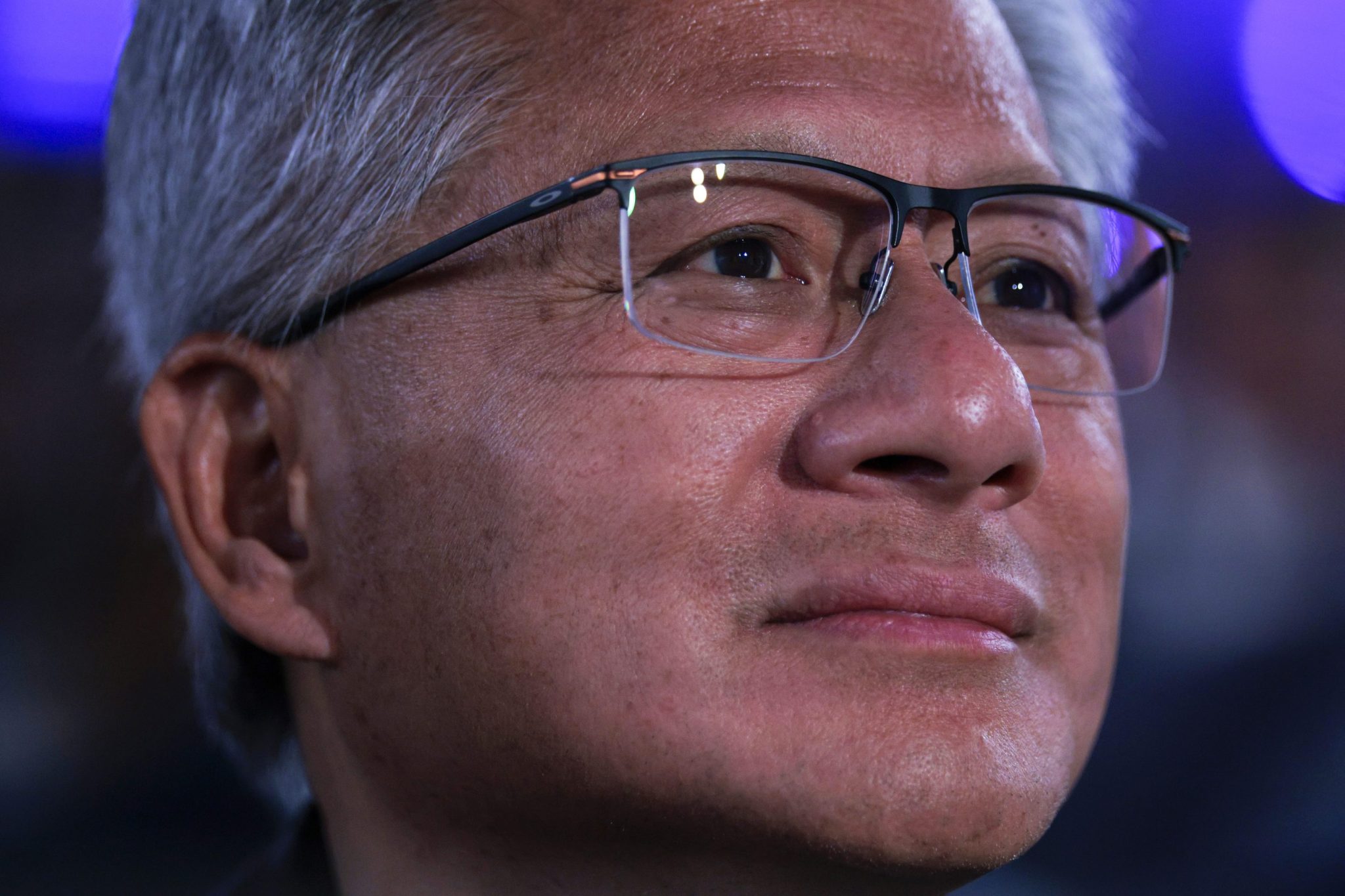

Nvidia’s CEO Jensen Huang says electricians and plumbers will be needed by the hundreds of thousands in the new working world

PositiveFinancial Markets

Nvidia's CEO Jensen Huang emphasizes the growing importance of blue-collar workers like electricians and plumbers in the evolving job market. He predicts that as technology advances, these skilled trades will be in high demand, highlighting a shift away from the traditional tech-centric workforce. This perspective is crucial as it underscores the need for a balanced economy that values all types of labor, ensuring that both tech and blue-collar jobs thrive in the future.

— Curated by the World Pulse Now AI Editorial System