Fed Minutes Point to Holding Rates Steady | Bloomberg Businessweek Daily 11/19/2025

PositiveFinancial Markets

- The October FOMC minutes indicate that Federal Reserve officials are generally opposed to a rate cut in December, as discussed by Bloomberg hosts Carol Massar and Tim Stenovec. This cautious stance reflects ongoing concerns about economic stability.

- The decision to hold rates steady is significant as it suggests a commitment to maintaining economic balance, which could influence market confidence and investment strategies moving forward.

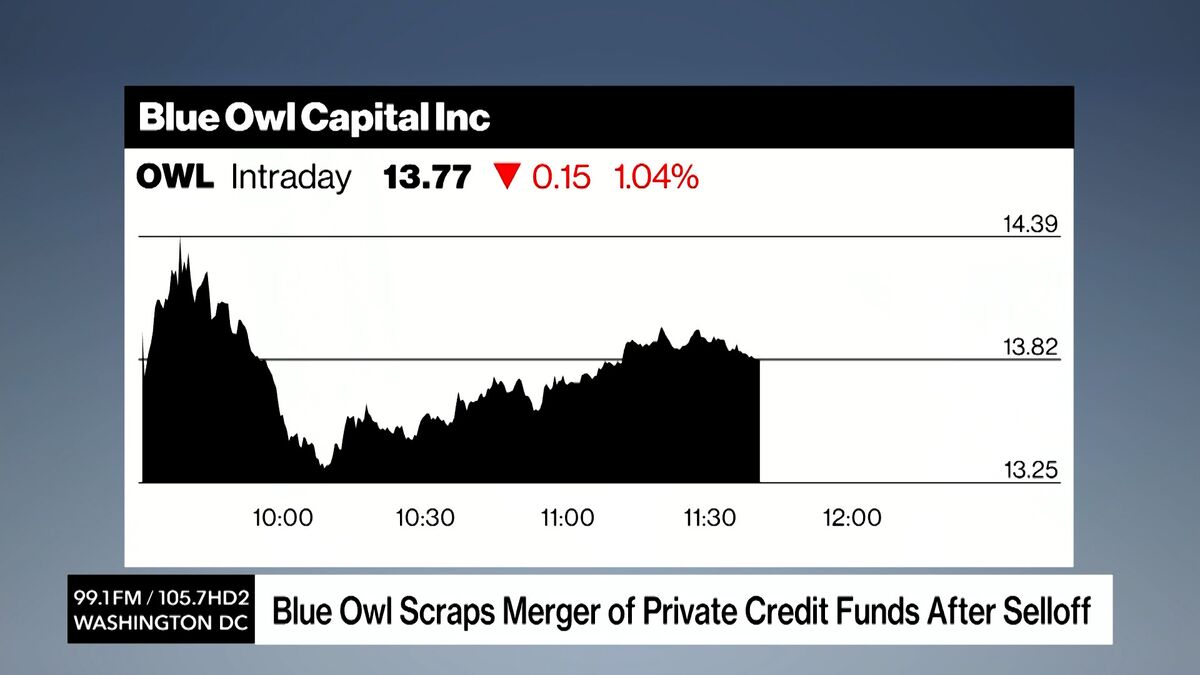

- The broader market context reveals a mixed sentiment, with Blue Owl's merger cancellation highlighting investor caution, while Lowe's and TJ Maxx's performances indicate resilience among frugal consumers amid economic uncertainty.

— via World Pulse Now AI Editorial System