S&P 500 Snaps Four-Day Losing Streak Ahead of Nvidia Earnings | Closing Bell

PositiveFinancial Markets

- The S&P 500 index has snapped a four

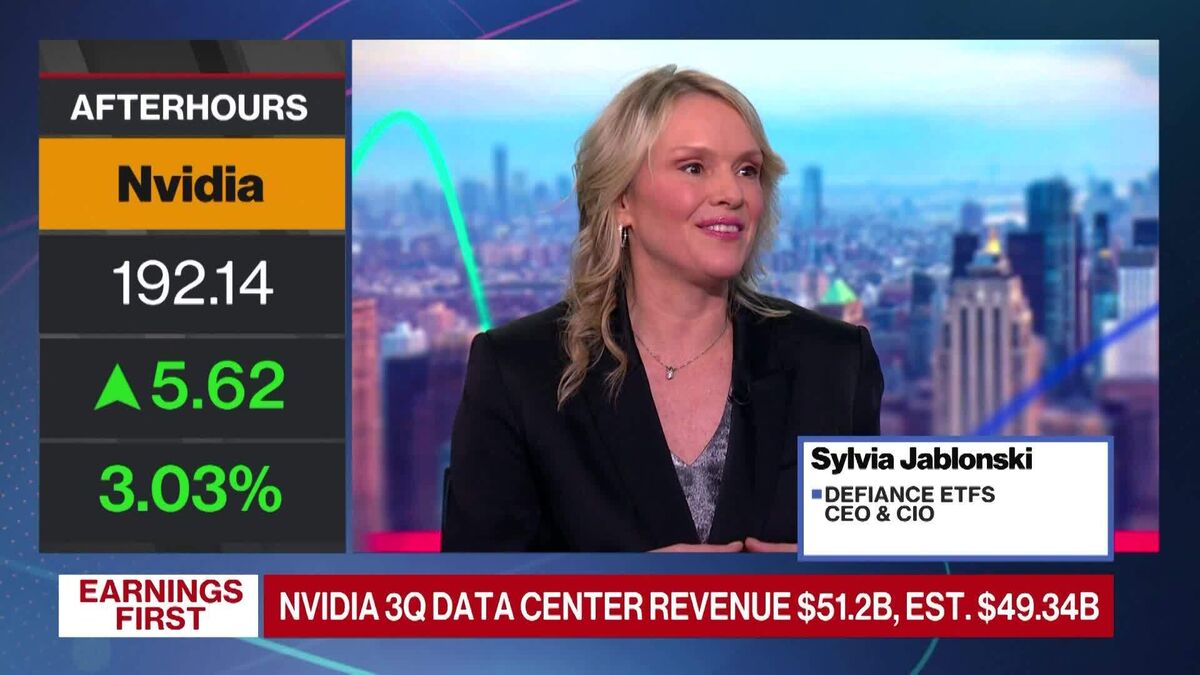

- Nvidia's upcoming earnings are critical as they are expected to significantly influence market dynamics, particularly in the tech sector, where the company plays a pivotal role. Investors are closely monitoring Nvidia's performance as a key indicator of market health.

- The recent fluctuations in the S&P 500 highlight ongoing concerns regarding the tech sector's stability, particularly amidst fears of an AI bubble and broader economic uncertainties. The market's response to Nvidia's earnings will likely set the tone for future trading sessions.

— via World Pulse Now AI Editorial System