Can Asia Shield Investors From An AI Bubble Burst? | Insight with Haslinda Amin 9/16/2025

NeutralFinancial Markets

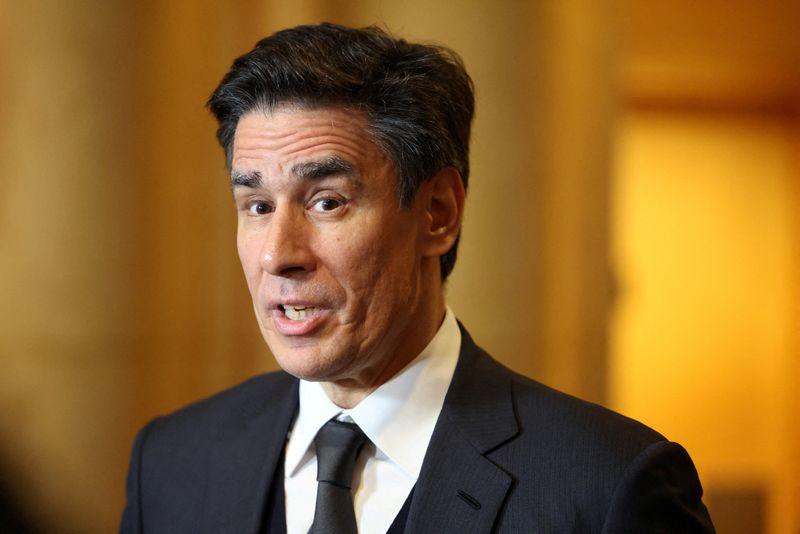

The program 'Insight with Haslinda Amin' explores whether Asia can protect investors from a potential AI bubble burst. It features interviews with leaders in various sectors.

Editor’s Note: This discussion is important as it addresses concerns about the sustainability of AI investments and the role of Asian markets in providing stability. Understanding these dynamics can help investors make informed decisions.

— Curated by the World Pulse Now AI Editorial System