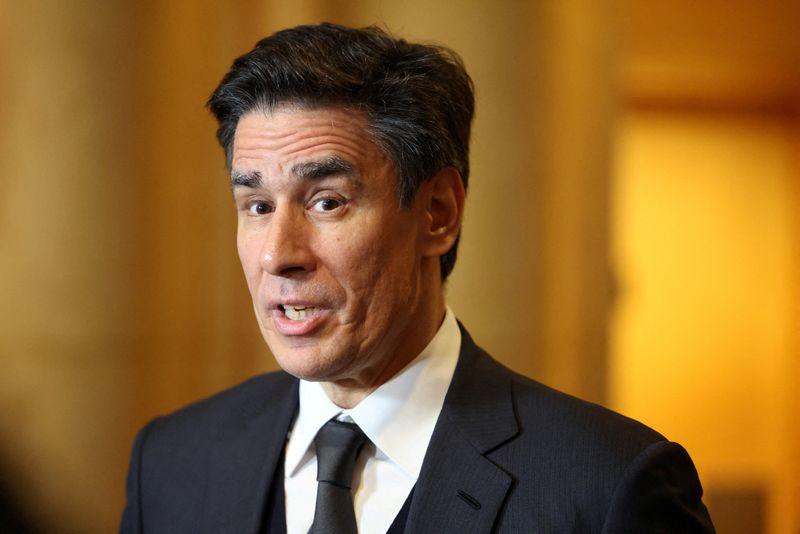

ANZ investors brace for short-term pain as new CEO Nuno Matos clears the decks

NeutralFinancial Markets

ANZ's new CEO Nuno Matos is making significant changes, which may lead to short-term challenges for investors. The restructuring aims to improve the bank's long-term performance.

Editor’s Note: This situation is important as it reflects the bank's strategy to adapt to market conditions. Investors need to understand the potential impacts of these changes on their investments and the overall financial landscape.

— Curated by the World Pulse Now AI Editorial System