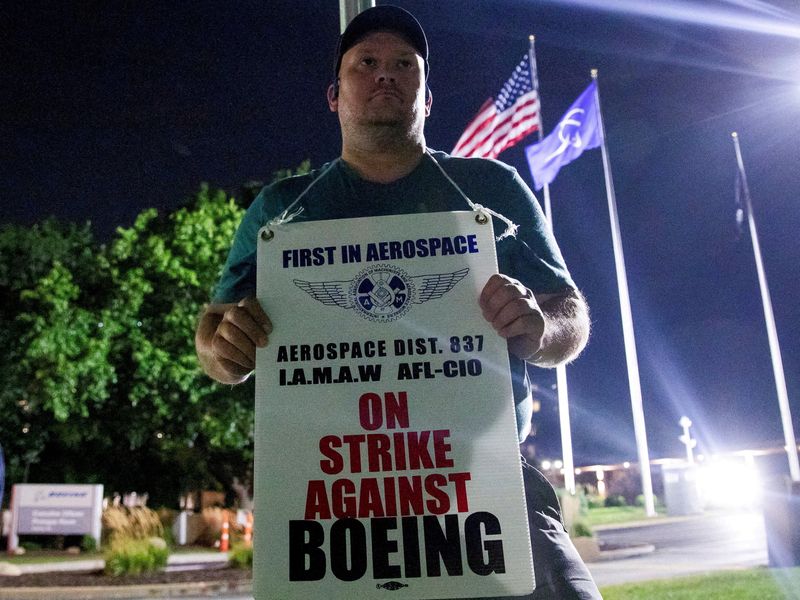

Fed’s Barkin says employment trend moving in wrong direction

NegativeFinancial Markets

Federal Reserve official Thomas Barkin has expressed concern over the current employment trends, indicating that they are moving in the wrong direction. This is significant as it suggests potential challenges for the economy, which could impact job growth and stability. Barkin's remarks highlight the need for careful monitoring of labor market conditions, as shifts in employment can have widespread effects on economic recovery and consumer confidence.

— Curated by the World Pulse Now AI Editorial System