High Inflation Persisted In August As Spending Slowed

NeutralFinancial Markets

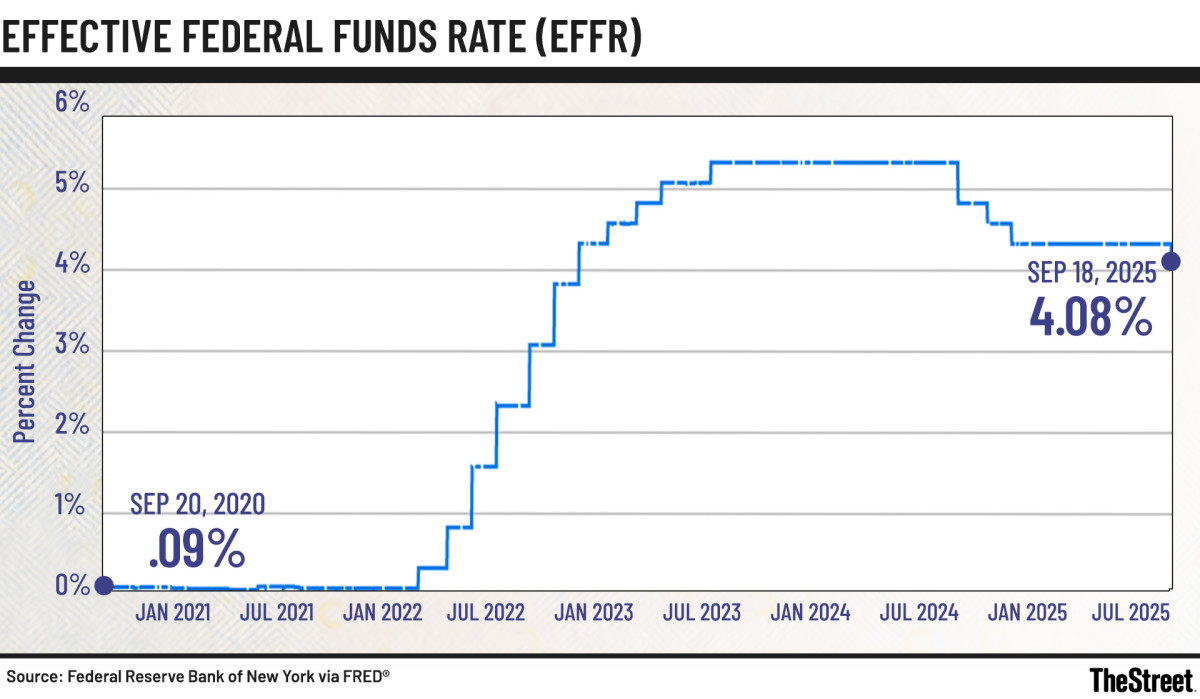

In August, inflation continued to be a concern as spending showed signs of slowing down. Fed Chair Jerome Powell recently indicated that the immediate risks associated with inflation have improved, which could signal a shift in economic policy. This is significant as it reflects ongoing challenges in the economy and the Fed's response to them, impacting consumers and businesses alike.

— Curated by the World Pulse Now AI Editorial System