S&P 500’s Torrid Rally Seen Having ‘More Fuel Left’ From AI, Fed

PositiveFinancial Markets

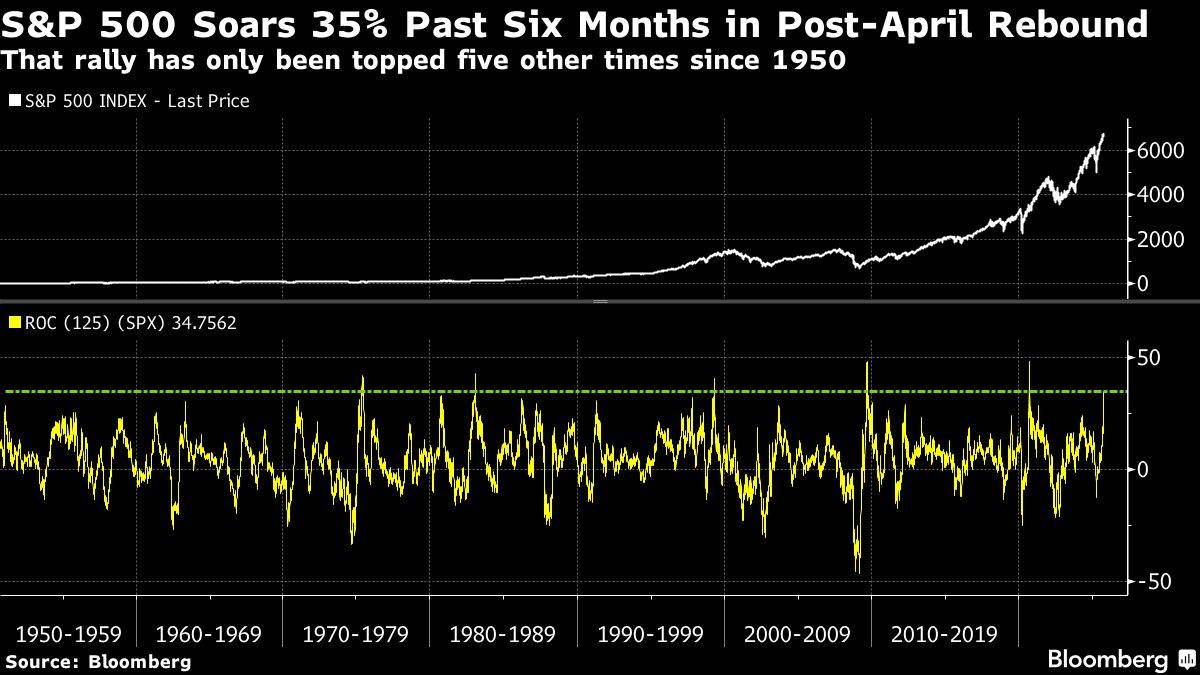

The recent surge in the S&P 500, which has rebounded dramatically from a bear market just six months ago, is being fueled by optimism surrounding artificial intelligence and supportive actions from the Federal Reserve. This rally is notable not just for its speed but also for its resilience, suggesting that investors may have good reason to believe that the upward trend will continue. As history shows, such recoveries often have more momentum, making this an exciting time for market participants.

— Curated by the World Pulse Now AI Editorial System