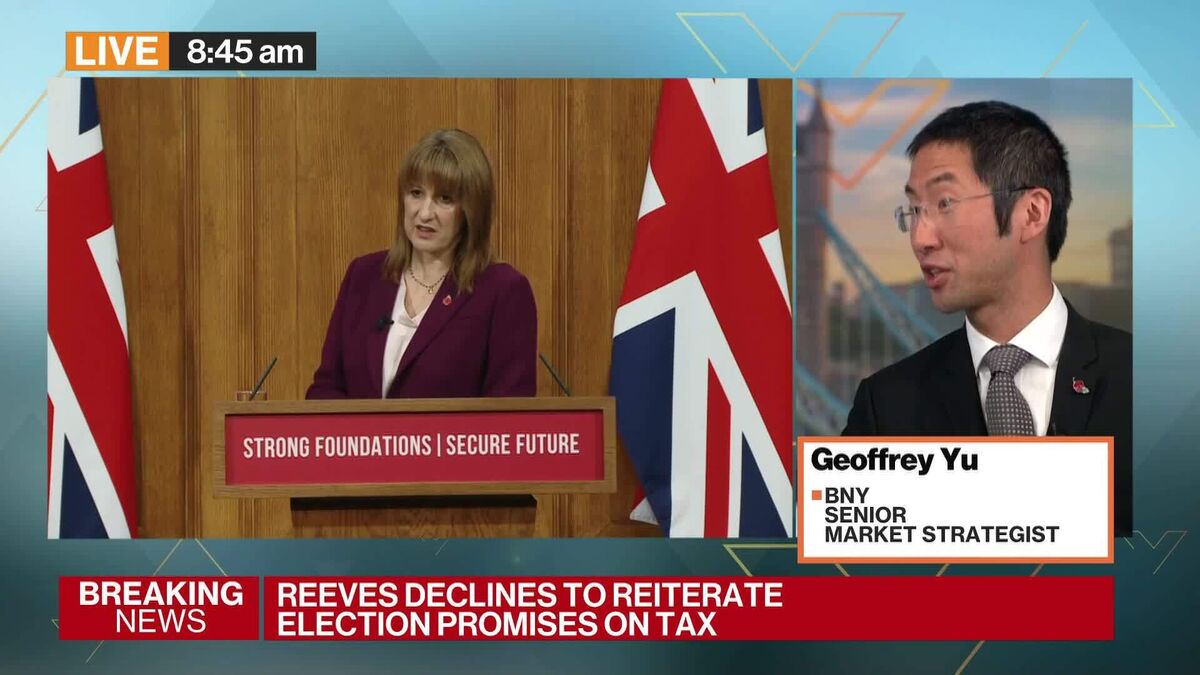

Rachel Reeves Signals Tax Rises to Tackle £22 Billion Fiscal Shortfall in November Budget

NegativeFinancial Markets

Rachel Reeves has indicated that the upcoming November budget may include tax increases to address a significant £22 billion fiscal shortfall. This news is crucial as it highlights the government's struggle to balance the budget and the potential impact on taxpayers. With rising costs and economic pressures, the proposed tax rises could affect households and businesses alike, sparking discussions about fiscal responsibility and economic growth.

— Curated by the World Pulse Now AI Editorial System