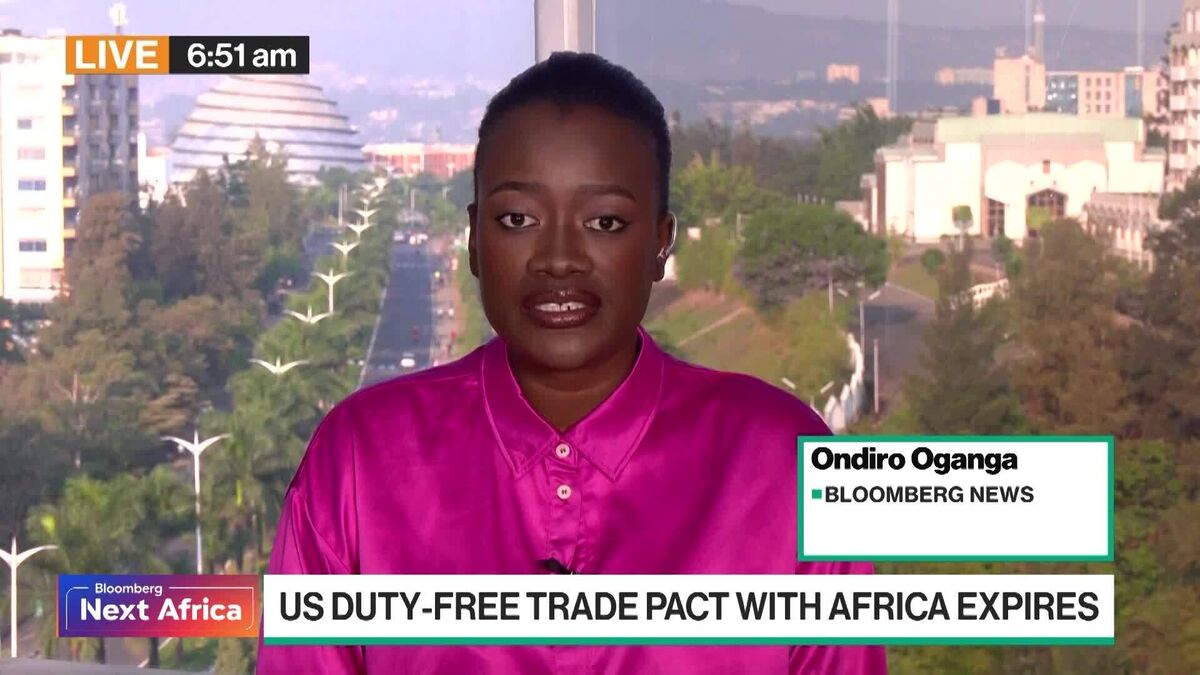

US Duty-Free Trade Pact for Africa Expires

NegativeFinancial Markets

The expiration of a US trade accord that provided duty-free access for 1,800 African products has left many investors and exporters uncertain about the future. While the Trump administration has indicated support for a one-year extension, the legal ambiguities surrounding the agreement are causing concern. This situation is significant as it impacts trade relations and economic opportunities for African nations, highlighting the importance of stable trade policies.

— Curated by the World Pulse Now AI Editorial System