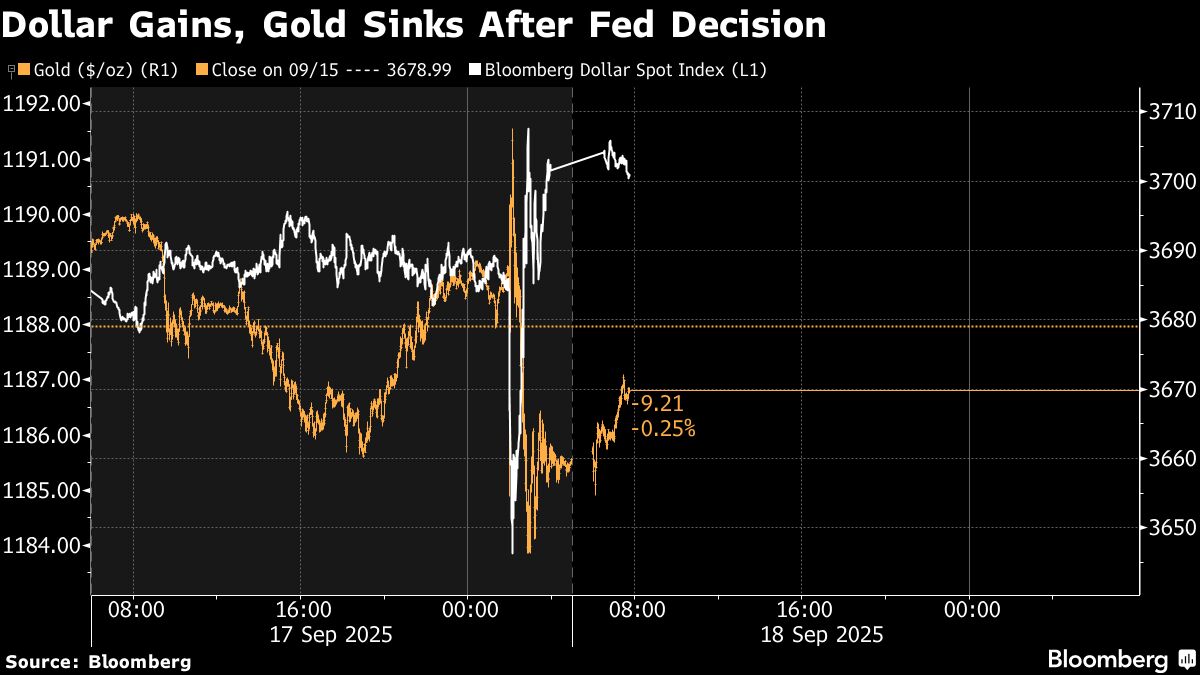

Dow Climbs, S&P 500 Slips After Fed Cuts Interest Rates

PositiveFinancial Markets

The Dow Jones Industrial Average has seen a significant climb following the Federal Reserve's decision to cut interest rates, which has fueled optimism in the stock market. This move is important as it reflects the Fed's commitment to supporting economic growth, and it has contributed to record highs in stock prices. Investors are hopeful that lower borrowing costs will stimulate spending and investment, further boosting market confidence.

— Curated by the World Pulse Now AI Editorial System