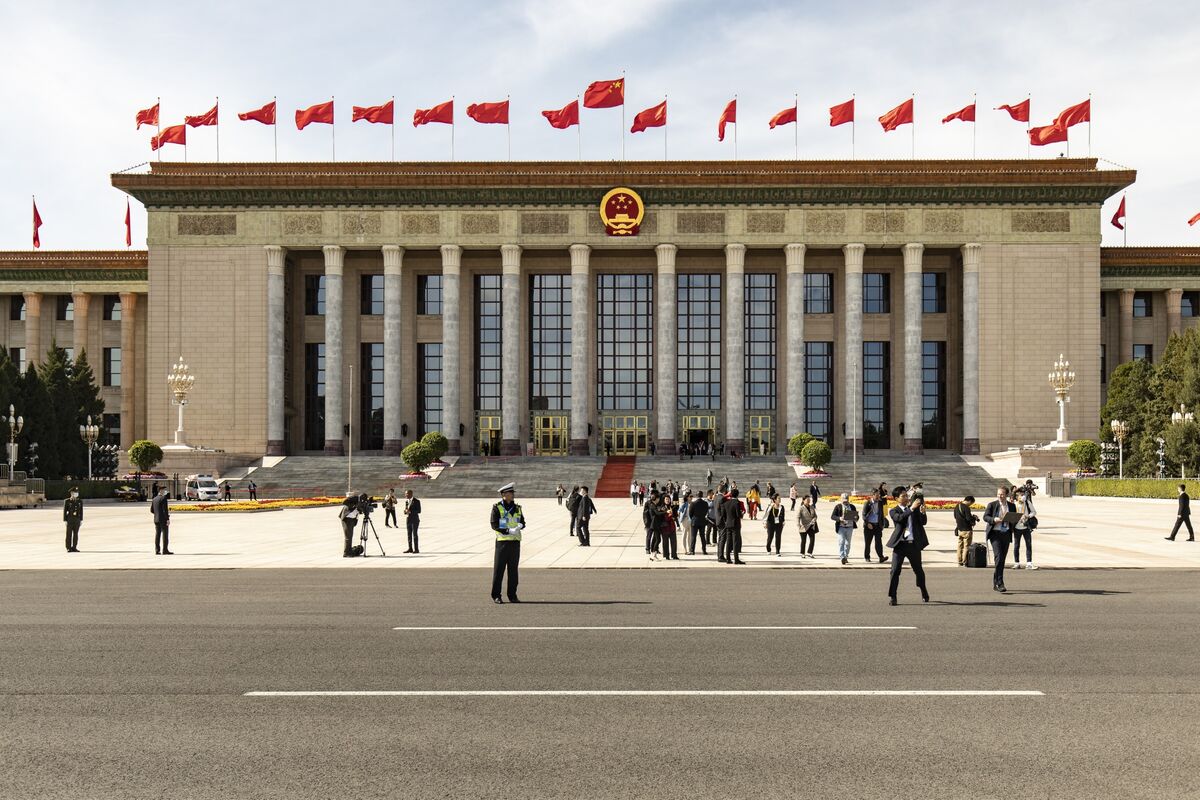

Metals Edge Higher as US-China Leaders Prepare for Trade Talks

PositiveFinancial Markets

Base metals are seeing a rise as the leaders of the US and China prepare for trade talks, signaling a potential easing of tensions between the two economic giants. This is significant because improved trade relations could benefit global markets and boost economic stability, making it a crucial development for investors and industries reliant on these metals.

— Curated by the World Pulse Now AI Editorial System