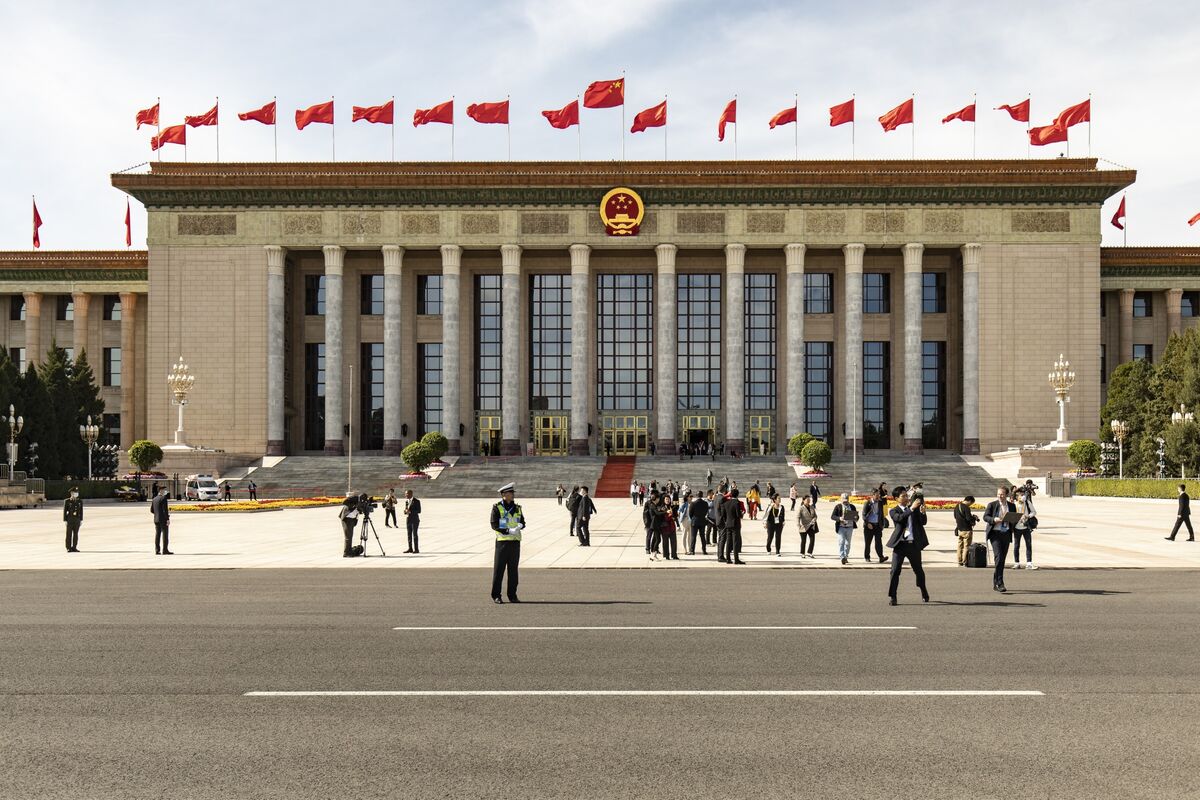

China Reassures Foreign Firms on Export Controls at Huge Meeting

PositiveFinancial Markets

China recently held a significant meeting with foreign businesses to clarify that its new export controls are not intended to hinder normal trade. This initiative aims to alleviate concerns and backlash from the international community, showcasing China's commitment to maintaining a stable trading environment. Such reassurances are crucial for fostering trust and encouraging continued investment from foreign firms.

— Curated by the World Pulse Now AI Editorial System