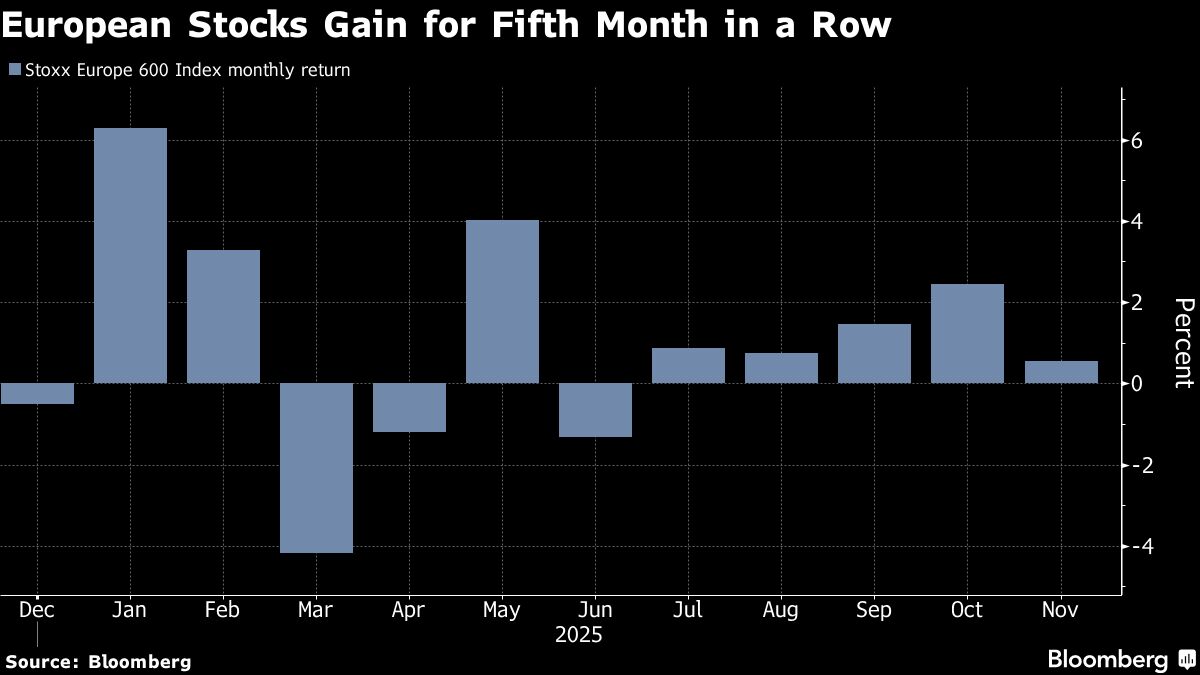

European Stocks Rise to Post a Fifth Consecutive Month of Gains

PositiveFinancial Markets

- European stocks have risen for the fifth consecutive month, marking the longest streak of monthly gains since March 2024, as reported by Bloomberg. This positive trend reflects a recovering market sentiment among investors.

- The sustained rise in European stocks is significant as it indicates growing investor confidence and may attract further investment into the European market, potentially leading to increased economic activity and stability in the region.

- Despite this positive momentum, the market remains cautious due to mixed performances in recent weeks, particularly influenced by economic challenges in the U.K. and fluctuations in technology stocks, which have raised concerns about valuations and future monetary policy.

— via World Pulse Now AI Editorial System